Good day, thanks for tuning in.

We initiated research on Plus Alpha in early August but thought the stock was too expensive. Since then, the stock has come down to more reasonable levels, so thought now would be a good time to share.

—

Disclaimer: The following write-up is no investment advice. The author may own, buy, and sell securities mentioned in this post. Please do your own due diligence.

The main idea: Plus Alpha Consulting owns Talent Palette, a talent management software for large enterprises. Talent Palette is an excellent business for the following reasons:

Talent Palette holds the no 1. position for large enterprises, exhibiting extremely high switching costs.

Talent Palette has the best features and capabilities in the market by far. It is also the best-positioned to implement AI.

Talent Palette has the best customer acquisition strategy and cost structure.

Pre-ramble:

As Japan’s birth rate and population continue to decline, there has been a massive push to increase labor productivity.

Japan continues to have one of the worst labor productivity in the world for a developed country.

It’s very well known that Japan has a very tough work culture. Employees work extremely long hours and have extremely rigid hierarchies.

Employees are expected to stay in the office until their boss leaves, even if they don’t do anything. Turnover and workplace competition is extremely low; once someone is hired, they are typically employees for life.

Downsizing is often looked down upon. In fact, many companies are known to have “useless departments” that simply do not provide much value to the company yet are kept on.

Aside from that, employees are often overworked — loneliness is at an all-time high leading to tired and unhappy workers.

While younger Japanese are seeing changes, there has been urgent demand for software which improve workflow efficiency and labor productivity.

The software space in Japan has been rocky:

Japan’s industry was extremely successful during the 80s and at the time was projected to surpass the US. However, Japan did not embrace the rise of software and its implications on the rest of the economy was drastic.

The IT business was controlled by large oligopolistic system integrators. These firms handled outsourcing and development of IT systems and software as well as provided consulting and advisory services. While these firms did offer software, they didn’t have the speed of iteration or the culture of a startup to innovate against foreign peers.

As Tim Romero from the Disrupting Japan podcast put it:

“Software development was an exercise in box checking. You implemented a feature once the customer had asked for it and the contracts had been signed.”

Because Japan depended so much on system integrators, it stifled competition and investment in startups. Even today 75% of IT talent is still concentrated on System Integrators in Japan vs 35% in the US.

The fail-quick-and-learn-fast model adopted by the successful Silicon Valley startups never took off in Japan.

Software developers, even very talented software developers, were not encouraged to take risks and go against convention. Software developers were not respected like in North America, and were oftentimes considered a boring back-office low-skill career. They were not prized, and so there was not much of a career path they were encouraged to pursue.

By the time US software giants hit the shores of Japan, domestic software companies could not put up much of a resistance as these firms had vastly superior capabilities and technology that improved fast and continuously.

This was one factor that foreshadowed Japan’s lost decade in the 90s where domestic industry fell behind as IT and technology took over the world.

From the 2nd largest economy poised to take over the US, to one of the slowest growing as of recent, Japan has only now been able to recover from this…

The 2010s marked a revival of Japanese technology startups.

The process of software development became easier. The introduction of cloud computing, app development, more accessible programming languages, and better IT education and resources all helped to lower the barriers of entry.

Simultaneously, cloud software was quickly taking over on-premise software. Because cloud software can be accessed without heavy installation and maintenance requirements on your own systems, acquiring customers no longer required a lengthy sales cycle or tedious negotiation. As a result, the number of cloud applications exploded, many of them run by young visionaries.

As Japan’s workforce became more flexible and innovative, demand for talented software developers boomed.

The early 2010s marked the beginning of new software unicorns that could challenge legacy players.

Still, Japan has a lot of catching up to do. While on-premise solutions are on their way out, only 40-50% of software usage is on-cloud.

In the next several years, most on-premise software support will likely be shut down, which will force many firms large and small to adopt the cloud. Furthermore, companies will be forced to embrace AI, which is likely to be done by firms with more innovative culture rather than a system integrator run by older hierarchical teams.

The age of the startup has come.

This leads us to discuss a company that caught our eye.

—

Plus Alpha Consulting (TYO:4071) — market cap: ¥77B

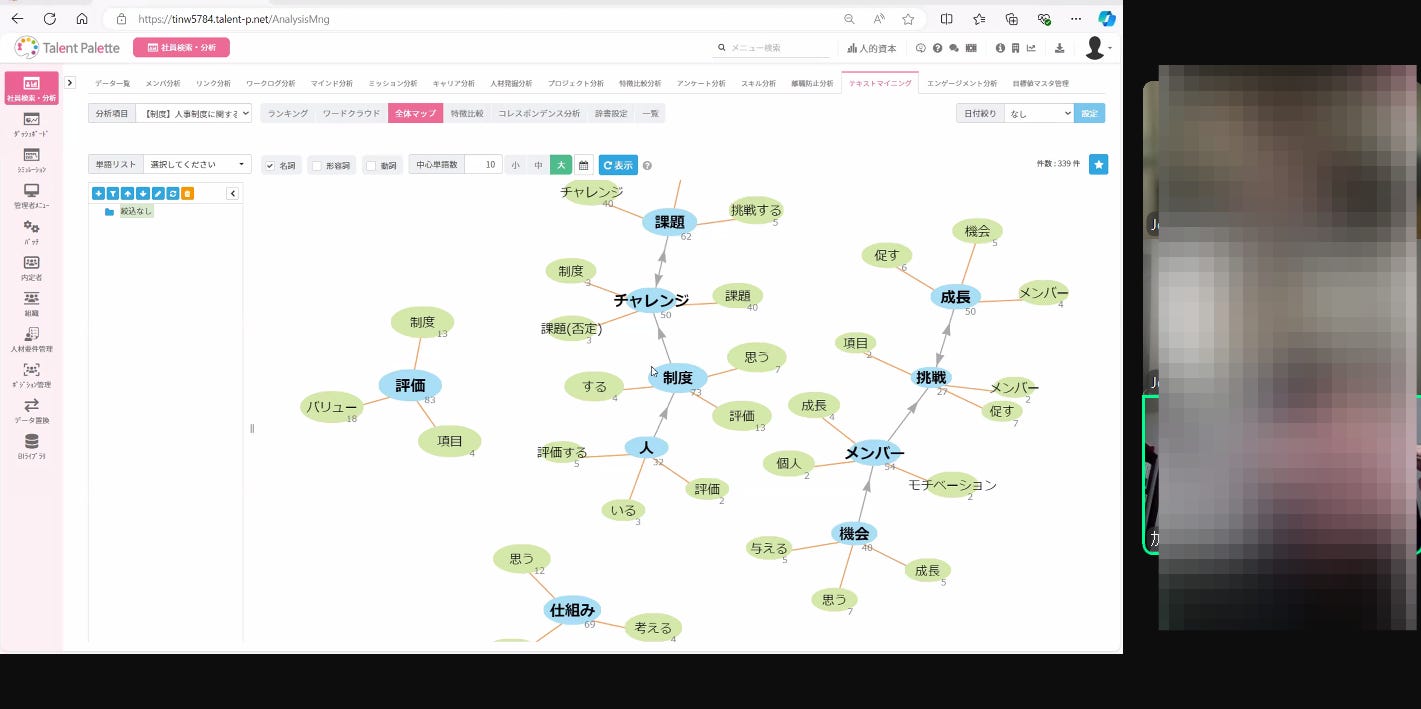

Plus Alpha Consulting was founded in 2006 by Katsuya Mimuro as a text data mining and IT consulting business. Text data mining involves analyzing text and calls and using machine learning to interpret the data. Mimuro previously worked for Nomura Research where he was obsessed with developing text data analysis tools. Mimuro would build a variety of solutions with applications in demand forecasting, customer analysis, AI, and information systems. While Plus Alpha started as a consulting service, Mimuro would pivot to focus on enterprise software. For the next 18 years, Mimuro would release a variety of products involved with text mining in a variety of verticals.

Today, only three products contribute the vast majority of revenue: Mieruka-Engine, Customer Rings, and Talent Palette.

Talent Palette (and other HR solutions): 73% of revenue, 50% operating margins for Talent Palette, 40% operating margins for consolidated segment

Launched in 2016, Talent Palette is a talent management software targeted to mid-size and large enterprises. Talent Palette provides a software solution to a variety of HR activities including managing employee data, matching projects to employees, performance and KPI monitoring, recruitment, feedback and evaluation, professional development, rewards and benefits, data visualization, and more. Talent Palette has increased revenue Five-fold over the past 5 years (>50% CAGR), and we believe Talent Palette is the best poised to benefit from the Japan-wide drive to improve labor productivity.

Mieruka-Engine: 14% of revenue, 53% operating margins

Mieruka-Engine was one of Mimuro’s earliest products which Plus Alpha launched in 2008. Mieruka-Engine is a text mining software which analyzes and visualizes data from social media, call logs, surveys, and text. Mieruka-Engine is primarily used for improving marketing and services. Customers primarily consist of large enterprises which use the software for their contact centers and marketing departments. Mieruka-Engine has seen low-growth over the past 5 years (4% CAGR).

Customer Rings: 13% of revenue, 30% operating margins

Customer Rings was launched in 2011. Customer Rings is a CRM software which specializes in using text mining to analyze and interpret customer communication. Customer Rings is used mainly for digital marketing. Customers are mostly in retail, apparel, cosmetics, general goods, and more. Customer Rings has grown a bit faster, largely driven by price increases - a 10% 5-YR CAGR.

Note: consolidated Plus Alpha operating margins are 33% which includes company-wide corporate overhead

Why the opportunity exists?

This is a small cap high growth stock trading at ~11x 2025E ev/ebitda — a more than reasonable price considering the strength of their competitive position.

Plus Alpha is down over ~30% ytd. The last quarter results sent the stock down ~25% due to higher than expected costs coming from newly acquired firms and lower forecasted profit growth which has sent signals of management’s concern about the increasing competitiveness of the HR tech space.

But we are not thinking about where the company will be in 2 years, we think about where it will be in 10 years. And in 10 years, we believe Plus Alpha is most likely to come out on top.

Plus Alpha has no debt and a ¥10B cash balance.

We think Plus Alpha can grow sales at a 20% cagr for at least the next 4 years with potential multiple expansion.

Competitive landscape

The talent management space (“TMS”) can be divided into three segments: SME (<200 employees), mid-size (>200 employees), and large enterprise (>1000 employees).

The SME segment is dominated by the likes of SmartHR, Money Forward, and Freee. These companies offer very user-friendly features that’s simpler, less features, but with easier set-up. The space has been getting crowded with a variety of new entrants, typically single-product apps. Furthermore, talent management software isn’t as mission critical as managing a 50-person team doesn’t exactly require a whole system. Instead, the primary competition comes from accounting software giants like Money Forward which have been expanding their HR and payroll systems in addition to their current finance software suite.

The Mid-size segment has been the main battleground for TMS companies. Main players include HRBrain, Talent Palette, and the no. 1 in this space, Kaonavi, which is currently the largest enterprise TMS player in terms of customer size. Even though it’s “mid-size," 200 people is a lot — this is where they become an enterprise. As such, there is exceeding demand for managing employee data and evaluating performance.

Then we have the large enterprise segment. Talent Palette is the no 1 player, followed closely by Kaonavi, then foreign players like Workday. These customers comprise all of the keiretsu, trading companies, and well-known Japanese brands. With over a thousand employees, moving from Excel to a proper software system increases productivity many times over. Data visualization, performance flow, text analysis, and other tools become more useful.

The table below shows comparison between Talent Palette and Kaonavi’s customer breakdown.

Talent Palette (1798 customers, ¥712M MRR)

Kaonavi (3963 customers, ¥763M MRR)

Note: Kaonavi and Plus Alpha have different definitions of mid-size and SMB (Kaonavi defines mid-size as >200, Plus Alpha is >300), so there is going to be overlap.

While this helps us understand the customer base, both Kaonavi and Talent Palette reports a firm with multiple subsidiary firms as one customer. In reality, the no. of registered companies that use Talent Palette is >3400 and approx. 4000 for Kaonavi — the gap isn’t as large as it seems.

Also, we can categorize each customer segment like this, but there’s no hard boundaries. The higher up you go in size, the more the customer prefers features and capabilities, while the lower you go in size, the more customers prefer user friendliness and simplicity.

Talent Palette’s Competitive Advantage: Switching costs

The enterprise software business is all about switching costs. How difficult and/or costly is it for the customer to move over to your competitor?

Talent Palette’s switching costs vastly exceed its competitors due to 3 key factors:

Feature richness and pace of feature roll-out

UI/UX complexity which creates a high learning curve

Huge data onboarding which makes migration tedious

Talent Palette has thousands of features and counting, many of which customers will likely never fully use. In fact, Talent Palette has added a whopping 5962 features since it’s release! We estimate this is at least 4x that of peers.

Talent Palette’s functions are extremely vast, covering personnel evaluation, project matching, employee data management, job applications, professional development, benefits, and more. Feature complexity ranges from something as simple as digital paperwork to AI analysis of employee peer reviews.

Here are some examples:

Keyword maps - pinpoints common words/phrases from feedback form

Employee view - manage employee data

Data dashboard - shows multiple data sets including distribution of employee relocation preferences

The key differentiator of Talent Palette is the many different ways users can analyze their workforce (mostly based on feedback, survey, and other consentual employee data). Talent Palette offers dozens of options for visualizing data, far better than any other peer.

Because text mining involves complex data analysis, AI has been in Talent Palette’s DNA since launch, with features such as automatically generating profiles, recommending KPIs, and matching employees to different assignments. The more employees Talent Palette acquires, the more data it will be able to use to improve its AI modules.

Through their immense data bank, scientific rigor, and complexity of their text mining and AI models, customers can learn many things about their employees such as:

if the employee is depressed, tired, or hates their job

if the employee has performed better than peers

which employees should be moved to a different department

which employees are most likely to resign

which employees should be promoted and which ones should be fired

Customers tell us Talent Palette helped them easily view identify depressed workers to give them mental help, understand the overall team morale and satisfaction, make better decisions on which employees to promote or fire, and more.

Talent Palette reduces the time needed to implement employee surveys, create presentations, do paperwork, and manage data.

As it takes time to get used to and understand Talent Palette, customers may start to require new HR hires to be trained with Talent Palette on the get-go. In fact, we’ve heard that knowing how to use Talent Palette is now becoming a requirement for getting HR jobs in the big firms.

Overall, these factors boil down to:

The sheer amount of functions, data input, and complexity creates a pretty steep learning curve. This undoubtedly reduces user-friendliness. However, this means customers are extremely entrenched in the product ecosystem.

The ROI of using Talent Palette is greater than peers due to the ever increasing capabilities of features and data applications. Customers find the product so useful that if they switch off they won’t be able to find anything comparable.

This makes Talent Palette have the highest switching costs in the space.

Let’s compare with Kaonavi:

Kaonavi was launched in 2012, being one of the earliest enterprise TMS software. Because of this, they quickly gained dominant market share early on.

Kaonavi has focused more on user friendliness than capabilities. This was confirmed when we spoke with Kaonavi’s CFO and ex-employees.

Kaonavi’s primary feature is being able to pull up employee faces. The product is called “Kao” (face), “navi” (navigation). Kaonavi has the core features one would expect of a TMS including employee data management, task management, evaluation forms, recruitment management, rewards, and benefits. Where they are lacking is the analysis functions such as textual analysis, GenAI recommendations, data visualization, personnel simulations, and performance analysis. They’ve recently introduced their own text mining module, but we hear it’s far too basic to compare to Talent Palette’s capabilities. Overall, Kaonavi has far simpler features, easily navigatable dashboard, and smaller no. of functions.

Kaonavi, like Talent Palette, charges different plans based on the number of employees and additional features requested. Kaonavi, when comparing on similar company size tier is cheaper than Talent Palette. Also, because Kaonavi has a larger mix of smaller customers, their average price consolidated is much lower as well. As such, Kaonavi’s monthly ARPU is lower than Talent Palette’s, ¥188k compared to Talent Palette’s ¥402k.

This explains why Kaonavi has become more popular among mid-size enterprises who may not have need for all the complex functions Talent Palette. But the drawback is smaller customers will always lead to higher churn than larger customers.

It’s much harder to change systems with 1000 people than it is to change with 200. TMS systems tend to store a ton of data. One employee alone could have 10+ years of data including projects they were involved in, key developments in their career, conversation and communication information, and more. The time it would take to migrate the data from 1000+ employees is astronomical! Because TMS systems involve each employee downloading their app and creating a separate account, migrating would also require each and every one to set up the software all over again. The larger the workforce, the more hassle it is to have them do that in an orderly fashion.

While Talent Palette has averaged an MRR churn of around 0.3%, Kaonavi has averaged a churn of >0.4%.

Talent Palette’s higher switching costs also gives them superior pricing power. On an annual basis for the past 5 years, ARPU has risen >12% while Kaonavi has risen 9%. This is a combination of upselling new features and price increases. (though we expect ARPU growth for Talent Palette to stay flat as competitive pressure has forced Plus Alpha and other firms to offer larger discounts, though price hikes on existing customers continue)

—

Kaonavi is in a structurally worse competitive position compared to Talent Palette:

The HR software space is getting very crowded, especially on the small customer end.

We believe the SMB TMS space is a no go — accounting giants like Money Forward and Freee have already replicated payroll and benefits, it won’t be long until they include check-in tools and data management, which are quite simple to build. Smart HR, the largest player in the SMB HCM space, is seeing competition on it’s core payroll tools and are trying to migrate to the TMS space by adding data management, feedback forms, and job application tools.

The mid-size segment is also facing increased competition. Kaonavi’s fiercest rival, HRBrain, has similar features with similar pricing.

They were acquired by Swedish PE firm EQT in 2023, a rare case of foreign private equity activity in Japan. EQT said HRBrain was the most user-friendly system with the best reviews. While HRBrain reportedly has about half the revenue of Kaonavi, we hear they are growing much faster in the lower end of the mid-size space.

We are also seeing a lot of SMB players trying to attack upscale segments. For example, Team Spirit, an attendance and time tracking system, historically focused on the SMB segment , has recently started targeting the mid-size enterprise space in an effort to boost margins.

The mid-size segment is huge — nearly 60,000 potential customers, >60% of which are still using Excel for HR functions or legacy systems. But all this competitive pressure forces price competition, which will hinder TMS players’s ability acquire customers.

The Plus Alpha Strategy: Customer acquisition structure

It’s tricky to compare customer acquisition costs because Plus Alpha doesn’t disclose sales personnel expenses.

Nevertheless, we can confirm that while Kaonavi has slightly lower revenue vs Talent Palette (¥8.6B vs ¥10.1B ltm), Kaonavi’s SG&A was 14% higher than Plus Alpha’s on a consolidated basis LTM — EBITDA margins was ~10% vs Plus Alpha’s ~35%!

This is not due to advertising: Plus Alpha has historically been more aggressive on advertising and trade shows and spent ~55% more LTM than Kaonavi. An ex-employee even told us during the late 2010s, you could not enter a taxi without seeing a Talent Palette ad.

The reason Kaonavi’s expenses were higher was due to personnel. Kaonavi has 2x more employees than Talent Palette and spends over ¥2 billion in personnel a year, mostly sales and product people. This is more than double what Plus Alpha spends on a consolidated basis.

Our guess is, again, Kaonavi is facing extreme competitiveness in the mid-market segment. More and more companies with similar functions and UI are offering better terms and extending the free trial period, putting pressure on firms to ramp up feature roll-out and sales.

Talent Palette is no doubt facing this too, but we think the sheer differentiation of the product and focus on the enterprise segment simply gives them a better cost structure which has allowed them to decouple ARR from SG&A whereas other HR SaaS cannot, all while growing faster than peers.

—

Talent Palette has another ace up it’s sleeve over Kaonavi: distribution network.

Kaonavi acquires almost 0 customers from sales partners or system integrators. Talent Palette on the other hand acquires about ~25-35% of it’s customers from distributors, which structurally leads to a better CAC. The lion’s share of distributor customer acquisitions come from consulting and IT service companies. The key drivers are NTT and Accenture. These system integrators will promote Talent Palette to their clients, which also tend to be mid-to-large enterprises. They take a commission, which is overall much cheaper than direct marketing. Talent Palette has been dedicated in adding more HR and IT service companies and training them to use Talent Palette.

Other key partners include large enterprises who themselves use Talent Palette,. Keiretsu like Mitsubishi have multiple relationships with other medium-to-large enterprises (suppliers, customers, etc.). Having a customer base of larger companies will generally lead to a larger aggregate number of companies in your network.

Plus Alpha’s marketing strategy involves a ton of consultants. About ~20% of the workforce are consultants. These consultants would go to a customer’s HR or executive team and provide advice for using the software and help customers learn about the various functions. They go the extra mile by initiating HR consulting projects with clients to help them better manage their employees and solve specific problems. This does the following:

Deepens Talent Palette’s relationships with existing clients which further drive down churn.

Provides an easy source of customer learning and finding ideas for new potential features.

Because customer service is so good, this raises the reputation of Talent Palette for both existing and prospective customers.

While it may seem overkill to put that much resources on customer service, dealing with large companies is a huge deal. In 2023, Mitsubishi Heavy Industries subscribed to Talent Palette, and not only implemented the software for it’s corporate workforce, but also implemented for all 8 of its domestic subsidiaries. The result was an acquisition of over 40,000 employees on Talent Palette! With organizations this large, having a strong consulting group to provide support is absolutely crucial for maintaining relationships.

In comparison, Kaonavi’s only major consulting partner is Recruit Holdings. Recruit owns about ~20% of Kaonavi. Because Recruit is one of Japan’s largest HR service companies, we initially thought Recruit was a major driver of customer acquisition, but our sources tell us Recruit does not contribute at all. Instead, the only reason Recruit invested in Kaonavi is to utilize their data to help improve their own services. Moreover, due to Kaonavi’s reliance on mid-size customers, they cannot get very good sales partners as mid-size enterprises will naturally have less connections or reach.

Nevertheless, management told us they want to have a stronger distributor network when TMS system popularity reaches an inflection point.

Overall, Talent Palette is evidently the better business. They already caught up to Kaonavi in revenue despite launching 4 years later. Indeed, ex-Kaonavi employees all tell us the scariest competitor is Talent Palette.

What about competition with Workday and SuccessFactor?

The core competencies are completely different where systems like Workday are used mostly for payroll and finance while Talent Palette is used for talent management.

Many of the keiretsu are using foreign HCM software like SuccessFactor, Taleo, or Workday, which also have talent management and visualization features:

In some ways, these systems are better than Talent Palette: they have better customizability and offer far more languages. But Talent Palette is obviously the clear winner in terms of employee analysis capabilities.

Actually, what usually happens is that most firms will use Talent Palette or Kaonavi for talent management on top of their payroll and benefits system. They might also have an international system for their head office but use Talent Palette or Kaonavi for the rest. For example, Panasonic uses Successfactor for the international headquarters in Japan but uses Talent Palette for all their local subsidiaries.

These established foreign software compete more with SmartHR Enterprise than they do with Talent Palette.

Growth runway

In Japan, there are about 58,400 mid-size enterprises, and 4,500 large enterprises.

Among large enterprises, we estimate about <40% penetration. Whereas among mid-size enterprises, we estimate about <10-15% penetration. Of course, the segmentation is more complicated than that: firms with >500 employees seems more likely to opt for Talent Palette than firms with less, so it’s not like Talent Palette will hit a wall once the 4,500 are filled. Overall, it seems like the penetration is low enough that TMS systems can grow for quite a long time.

What about the declining Japanese population?

It’s a valid point. Japan may lose a 1/3rd of their population in 50 years. Since Talent Palette charges per employee, this will no doubt bring some client's to lower pricing tiers overtime. But this also means there will be more labor shortages and thus more demand for labor productivity tools, which in our opinion should lead to a stable ARPU without accounting for further module cross-selling.

As seen from the graph above, the labor shortage continues to worse, motivating more companies to find better ways to attract and retain top-tier talent. If anything, the declining population will actually be a tailwind for software, possibly for more than the next decade.

What about concerns regarding Labor DX Lite?

One of the main criticism of bears is that Talent Palette is going to run out of growth when they reach saturation in the large enterprise segment. Talent Palette has been trying to enter the SMB space with the near-term release of Labor DX Lite, a simpler version of Talent Palette targeted to firms with <300 employees with a focus on payroll and benefits. Because this will naturally bring ARPU down, investors have been worried that this “land grab” is seen as a signal that Talent Palette is struggling to grow.

But…history tells us the story usually plays out differently.

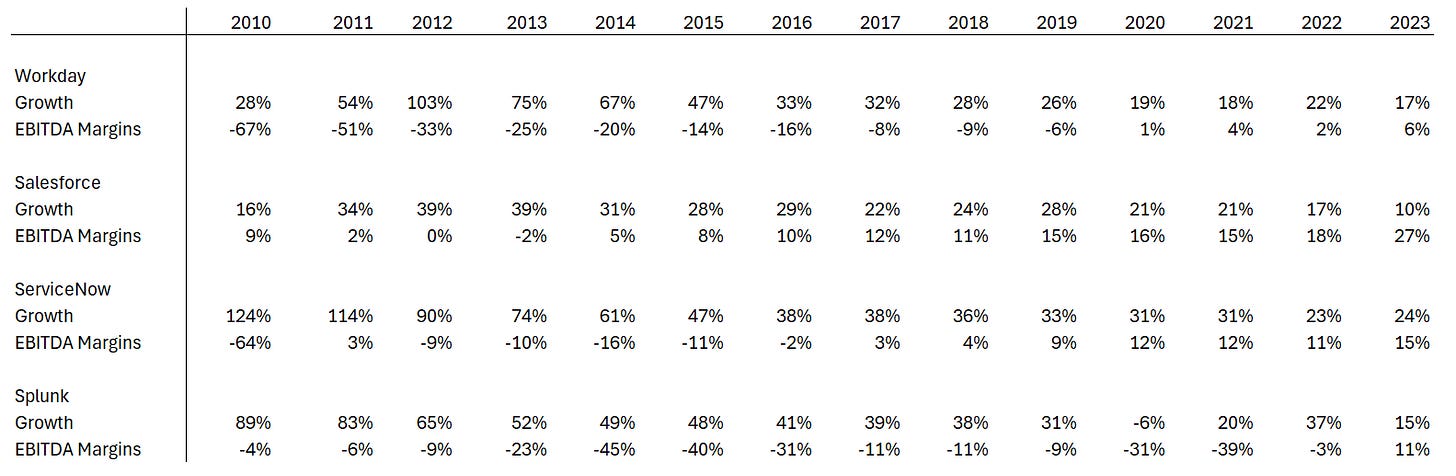

Cloud software companies like Workday and Salesforce have seen their profits surge amidst decelerating ARR growth. Why? Because with less customers to acquire, the focus shifts towards cost optimization. Direct marketing is less important while distribution gets all the focus. New modules surrounding the current product continued to drive up ARPU.

Some examples:

Salesforce, which was an enterprise-focused business, also released an SMB version in 2017, right at the time their sales growth started to decelerate. They did not displace HubSpot, but it did not affect the fundamentals of the enterprise business. Although Labor DX Lite may not be the best move, we do not think this is a risk.

But Talent Palette is already very profitable, how much more profitable can it go?

OBC, a great case study for Japanese enterprise software, reached consolidated EBITDA margins of >45% despite relatively slow growth (8% 10-YR CAGR) through a combination of its dominant market position and strong network of 3000+ distributors. And remember, their software targets SMBs with a bit over half their revenue still in on-premise software. While it would be difficult for Talent Palette to achieve that distributor network, we think a stronger shift to a distribution model in the future could still be very accretive to margins.

It might also be worth noting that most new customers will often use Talent Palette for a small portion of their workforce before doing a company-wide implementation. We think most customers using Talent Palette for <1 year are doing this, which implies there is going to be TAM in customers eventually expanding Talent Palette’s coverage to the entire workforce, thus increasing ARPU and margins.

—

We expect CAC for all firms to go up over time as the space gets more competitive, though we think there is enough space for multiple firms to cement themselves — this won’t be winner takes all.

For these reasons, though Kaonavi is in a worsening position, they still have a very bright future ahead. Kaonavi’s efforts to replicate some of Talent Palette’s features like text mining and its larger focus on enterprise customers is a good signal despite decelerating YoY sales growth. In fact, if Kaonavi is able to build up a distribution network and be more disciplined with costs, they might be able to drive up margins closer to industry average, which would likely cause a multiple re-rate from its 2x price-to-sales.

Both Talent Palette and Kaonavi have a long growth runway while being quite cheap for an enterprise SaaS company.

—

In the next post, we will be covering other software products as well as our thoughts on management.

Thanks for reading!