Disclosure: I own shares of GSMI. This is not investment advice, please do your own due diligence.

A bit over 3 years ago, I was a freshman at the University of Toronto. Attempting to join our school’s value investing club, I submitted a short 15-page report on the most popular liquor brand where I come from.

Now, I did not invest in this company.

3 years ago, it was trading at 7.5x after-tax earnings while generating >30% ROIC. The company was growing sales double digit every year and margins were constantly improving, not to mention is was a market leader.

So why did I not invest?

You see, back then, I was a new investor.

Back then, I knew little about the concept of pricing power, nor have I read classic mental models of See’s Candies, Maotai, or Coca Cola.

I knew a great brand was wonderful, but I did not understand how it could produce a compounder.

Well, I’ve been kicking myself in the ass ever since…the stock I pitched has since nearly tripled!

I knew the fundamentals have not changed much, and in fact was still trading at relatively cheap multiples. Yet the feeling of missing out has prevented me from truly revisiting this company. But now I have gained greater temperance, to not let previous misgivings cloud my thoughts.

In this post I will be discussing Ginebra San Miguel, the most popular gin brand in the Philippines and the worlds largest gin producer. Ginebra trades at ~10x 2025E after tax earnings, has consistently delivered double digit growth and high ROIC, and still has a huge growth runway to continue compounding.

…

Ginebra San Miguel (PSE: GSMI) | Market cap: $1.36 billion USD or P80 billion

Ginebra San Miguel is the world’s largest producer of gin and the Philippines is the world’s largest consumer of gin, taking >40% of the world’s gin consumption.

But why is gin so popular?

Gin was first introduced to Manila during the British occupation of Manila in 1762 and was initially accessible only to the Spanish and Filipino upper class via imports. In 1834, Ayala y Compania built the first local distillery and sold gin under the brand name Ginebra San Miguel as well as other liquor products.

In 1879, chemist Anacleta Del Rosario developed a formula to purify alcohol with a stronger body and smoother taste. Ayala y Compania acquired the formula and with new industrial equipment from France, started to produce Ginebra for the mass-market.

Gin became popular among the working class because it was affordable and available. Gin was cheaper to produce vs other liquors as it required no aging and was made with molasses, which was much cheaper than local ingredients used to make liquor such as nipa palm and imported feedstock. Ginebra thus became the most affordable commercial hard liquor of the time.

In 1924, Don Carlos Palanca Sr. acquired Ayala y Compania along with the Ginebra San Miguel brand and built a new distillery in Tondo, pioneering the production of gin using molasses. After World War 2, Palanca Sr. built mechanized bottling systems and expanded distribution throughout the country. At this time today’s most popular Ginebra bottles were introduced, including the iconic kwatro kantos.

Culturally, drinking is deeply embedded. Drinking sessions, called inuman or ginuman (gin + inuman), are common where liquor is shared with friends and family. This is typically at home but is also often done during celebrations, nights out, and during karaoke sessions. As the premier clear liquor, gin is also used frequently as the base for cocktails. Gin-mixing is extremely popular, especially among younger people. And this isn’t just a bar thing, people will just mix gin at home with everything, such as gin + coffee in the morning and gin + fruit juice after dinner. A lot of new combos gained popularity on Tiktok and Facebook. The most popular are Gin Pom, Gin Mojito, and Red Alert (this would definitely kill you if you drank it everyday).

The conglomerate San Miguel Corporation, which owns San Miguel beer, bought Palanca Sr’s company in 1987. Currently, the firm is 76% owned by its subsidiary San Miguel Food and Beverage. Today, Ginebra San Miguel comprises >90% of the country’s entire gin consumption, selling over 410 million liters every year.

We estimate the Ginebra San Miguel brand accounts for at least ~90% of total sales volume and total sales. In 2024, Ginebra and the company’s second most popular drink Chinese wine brand Vino Kulafu, comprised ~99% of total sales. The other 1% of sales come from the company’s other brands, including Antonov Vodka, Primera Light Brandy, Anejo Gold Rhum, Don Enrique, and more.

—

The Ginebra mindshare

We now turn our attention to Ginebra’s source of pricing power, which I believe comes from their mindshare. This is a mix of:

1) cultural embeddedness and iconography of the Ginebra brand

2) cost leadership/affordability compared to all other clear spirits

3) accessibility across most of the country for the working class

Branding

Ginebra is an almost 200-year old brand with a long history. The brand has been a household name since the early 20th century.

It’s so ingrained in Filipino drinking culture that when people think of inuman, there are only a few names that come to find: Ginebra is one of them.

Fernando Amorsolo, the most famous Filipino painter and friend of the Ayalas who sponsored his studies in Madrid, designed the bottle art for Ginebra in 1917. Despite some modifications over the years, the logo art retains all the important pieces of the original drawing. This branding continues to be one of the most iconic piece of commercial art throughout the country.

Local vernacular have slang names for several of their products. For example, when someone asks for a bilog, they are referring to Ginebra’s Gin Round series. Or when asking for a kwatro kantos, they are referring to Ginebra’s Frasco series. Other slang such as gin bulag (gin-blind) and ginuman are also common and almost always refer to Ginebra’s original product line-up.

Search up anything related to gin + Philippines on Youtube and you will not find anything other than Ginebra pop up (or their basketball team).

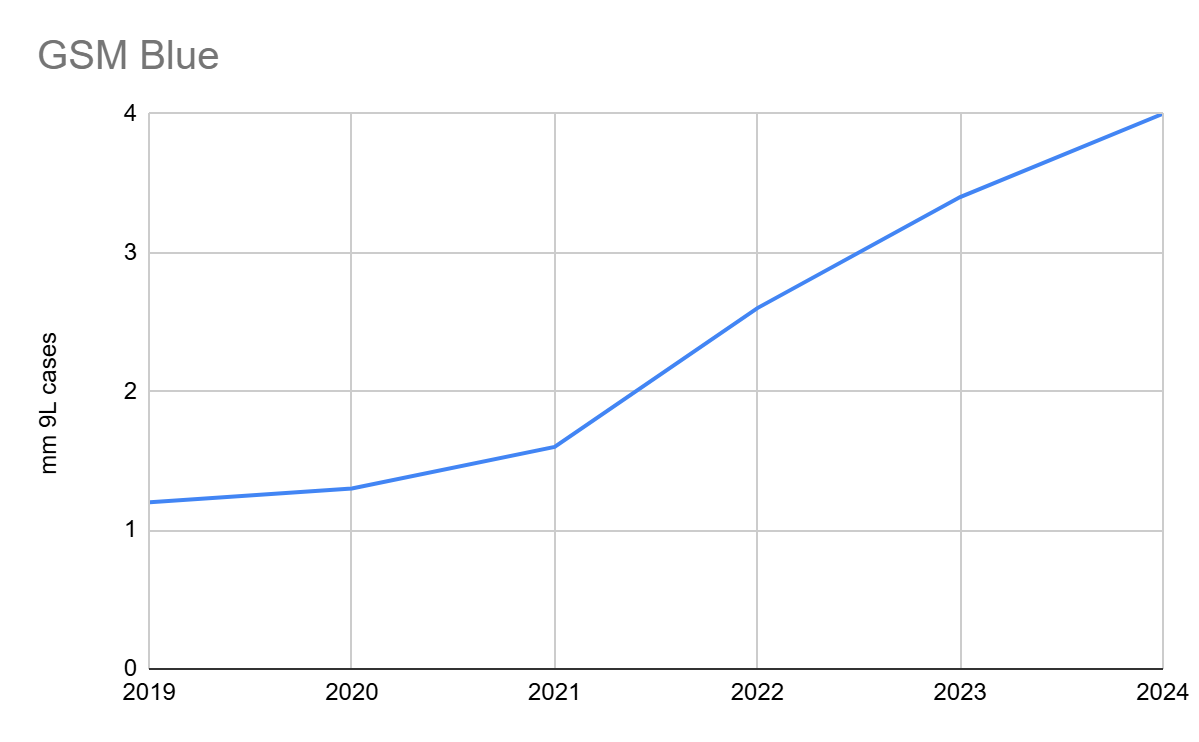

GSM Blue is a lighter version of the original and is very popular among younger people and new drinkers. GSM Blue have variants made specifically for cocktails such as GSM Blue Pomelo and GSM Blue Mojito. They have grown substantially within the past few years and is now the world’s fastest growing gin brand according to Drinks International, demonstrating successful efforts to bring the younger generation into the Ginebra customer base. As remarked in the 2025 Millionaire’s Club report:

“The continuous growth [of GSM Blue and Ginebra] in 2024 was driven by a rising nationwide user base driven by the younger users. Gin mixing is widely popular here as it provides our consumers another new way of enjoying the gin drinking experience apart from drinking it on a per shot, with ice basis.”

I think it’s worth also talking about Vino Kulafu. Vino Kulafu is mostly consumed for the nutritional benefits associated with the Chinese herbs in its ingredients. Vino Kulafu is popular because it stems from Kulafu, which was one of the first Filipino comic book heroes back in the 30s and is now a cultural icon. Since 2017, the drink held over 60% of the market share by volume. I estimate they are currently selling 4M cases annually.

There have also been plenty of superstitions surrounding Vino Kulafu that have contributed to sales. According to some customers, drinkers believe it will improve reproductive health. The drink is most popular in the south, Mindanao and Visayas, where it’s so culturally embedded that Vino Kulafu’s slogan became “Mindanao’s number one medicinal wine.” (ironic as Mindanao is majority Muslim). Most of its competition come from foreign brands and See Hok Tong produced by Destiliera Limtuaco. We estimate Vino Kulafu has a >60% market share for Chinese wine and comprises about 7.6% of total GSMI sales volume.

Cost leadership

Ginebra is the most affordable gin and clear spirit in the market by far, priced a bit over $1 dollar for a 350ml bottle. (Vino Kulafu has a similar price on ave.)

Price is king in a country where the daily minimum wage is below $12 a day. The next largest gin brands such as Gordon’s and Bombay Sapphire are over 8x the price.

(GSMI’s pricing is similar to other leading spirits such as Tanduay rhum and Emperador brandy, though they are aromatic spirits. We will talk about them later.)

In terms of taste, Ginebra is smooth and almost syrupy, probably because it’s made of molasses instead of grain. Flavour profile is distinct in that Ginebra is less juniper and more anise. However, since Ginebra positions itself as a cost leader, it’s not known to have the best taste — obviously a premium gin would beat Ginebra any day. But at 40% ABV, it’s really affordable if you want to get a kick or use it as a base for cocktails, which I think is really the purpose of most clear alcohols. Now Ginebra’s longtime liquor competitor LT Group (which owns Tanduay) released gin brand Ginto in 2021. But it is slightly more expensive and is not clear since it’s barrel-aged.

Accessibility

Ginebra is distributed widely, especially in Metro Manila, and can be found in most sari-sari stores, these are little variety stores targeting the working class. Sari-sari stores account for 40% of all FMCG sales and are most common in urban sprawl but are also scattered around rural provinces.

In the next post, we will discuss the Ginebra supply chain and how they are so accessible.

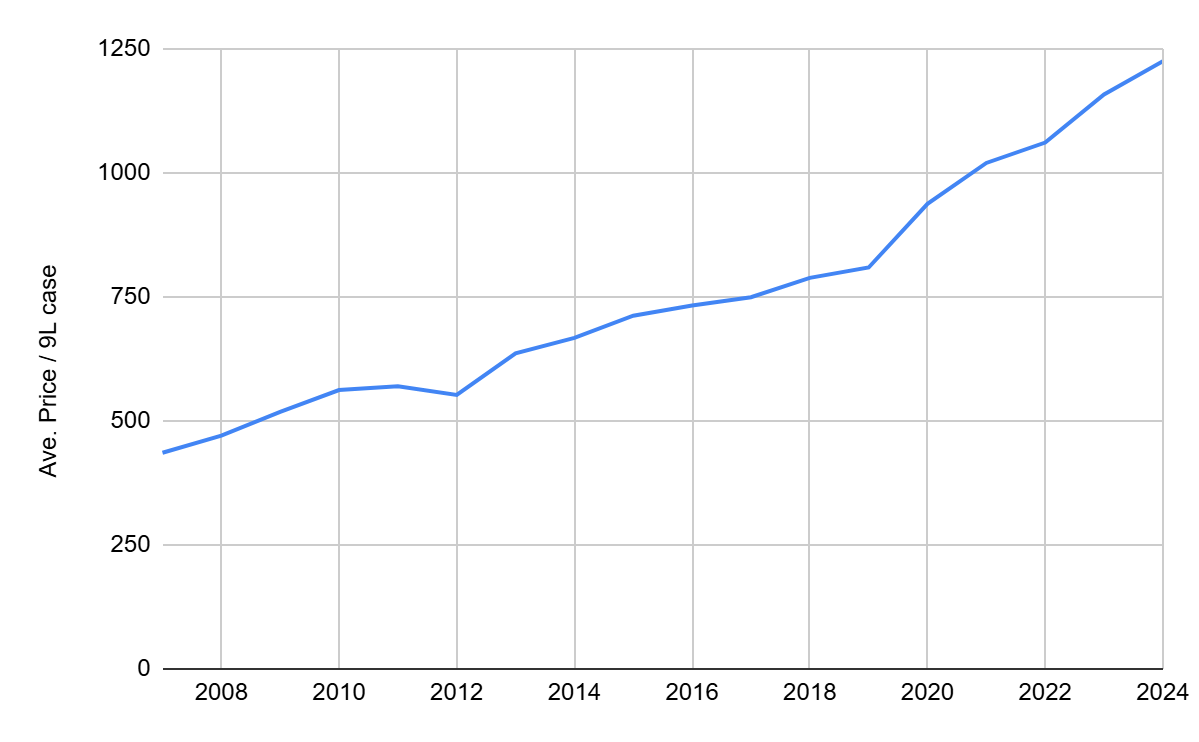

Due to Ginebra’s mindshare, Ginebra has been able to raise prices continually while maintaining volume growth and market share. In fact, Ginebra has been able to keep prices above inflation most years. Most retailers and sari-sari stores I see have simply passed each price increase to the end-consumer, maintaining markups of 15% (stores typically markup 15-20%, so this is at the lower end).

The chart below shows GSMI’s aggregate ave. price/9L case for nearly the past couple decades.

While the Philippines average inflation rate since 2010 has been 3.4%, Ginebra has been able to raise its prices 6%.

Price increases have been even steeper since the pandemic after excise taxes on alcohol were increased: ad valorem tax went from 20% to 22% of net retail price in 2020 (Ginebra upped their prices 16%) while specific tax per proof liter has increased close to 10% per year and is now set to increase 6% per year (now P70 per proof liter). In fact, in 2024, 44% of sales went to paying excise taxes vs 36% in 2020.

Ginebra seems to be able to continually pass on these increases to their customers — gross margins have remained at 24-25% over the past decade.

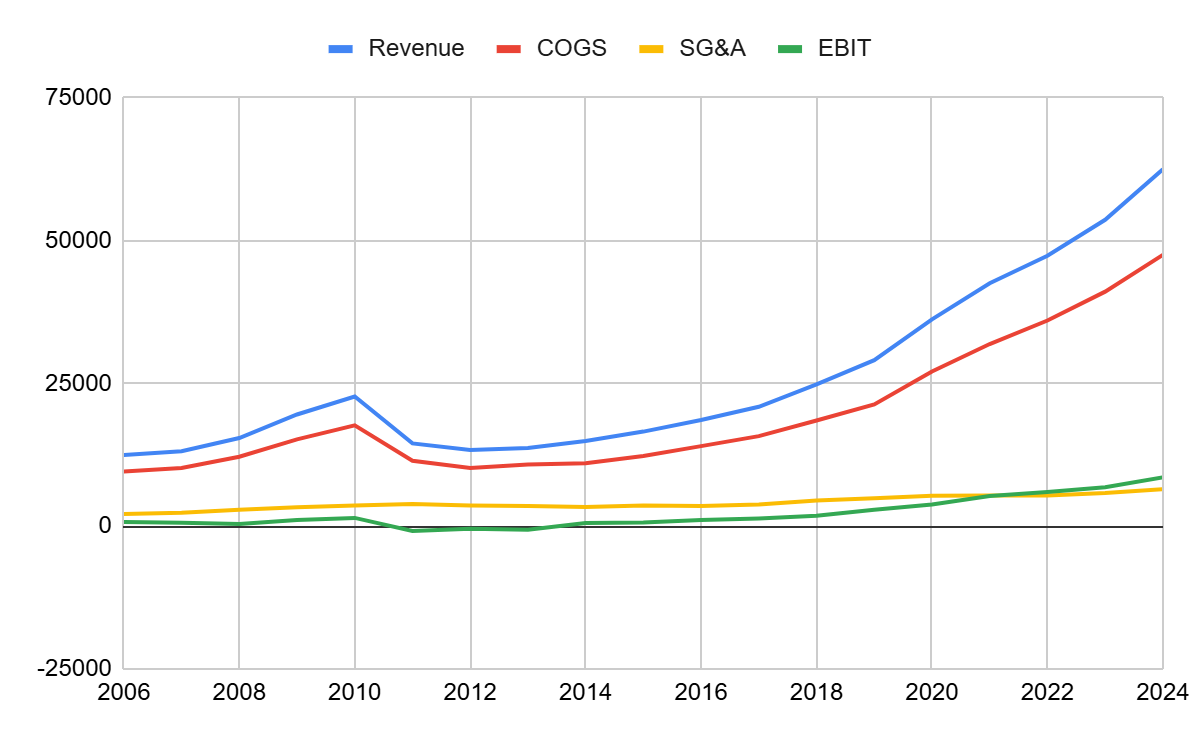

Revenue growth has averaged 10% since 2007, and volume + pricing have continually gone up with the exception of 2011-2013.

All the while SG&A has been growing at a slower pace, leading to operating margins coming from 4% post-2013 recovery to nearly 16% as of Q2 2025.

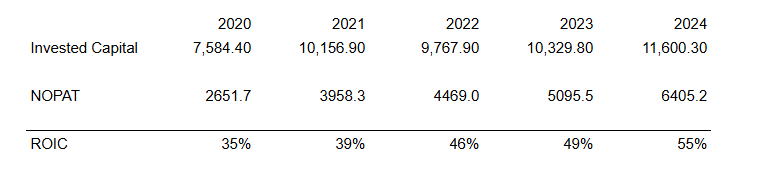

This divergence between earnings growth and costs have also translated to capital employed in the business. This, and due to the huge P14 billion net cash position, has led to high returns on capital employed.

…

But what happened in 2011-2013?

You see, prior to 2011, about 23-28% of sales have been coming from Gran Matador, Ginebra’s brandy line which was released in 2003 to compete against the most popular brand Emperador.

Early on, Gran Matador gained traction and was seemingly becoming a mainstay of Ginebra’s product line. However, in 2011, Emperador released one of the best selling alcohol launches of all time: Emperador Light. The year Emperador Light was launched, the brand doubled its sales volume from close to 10M cases to 20M. The next year, it was selling 30M.

Emperador Light was sweeter and had a lower ABV of 27.5%. While Gran Matador tried to undercut prices, Emperador focused on brand positioning and won the younger generation. In 2011, Gran Matador went from selling 10M cases a year to 2M.

According to Drinks International:

“Where once San Miguel’s Gran Matador was the brandy du jour now it is Emperador. When asked, consumers told DI they switched for its rounded, sweeter taste and slightly lower abv. The spirit is mainly drunk neat or with a mixer.”

Meanwhile, Ginebra San Miguel sales volumes increased 25% est though saw a 17% decline in 2012. In response, management introduced several new GSM flavors including a Light version of GSM Blue at also 27.5% ABV and other GSM flavors.

Then, in 2013, a sudden tax hike, known as the Sin Tax Reform increased specific tax rates on distilled spirits by over 50% and ad valorem tax rates by 33%. Tax reforms also hiked excise tax on lighter alcohols like beer in a similar fashion. The hike was implemented just 12 days after announcement of signage, leading to a nationwide slowdown in wholesale purchases. This did not affect the company as bad as 2011 though and Ginebra San Miguel sales volumes were only down <4% for the year.

Nevertheless, unpredictable tax levy is one concern I have as if future tax increases go too far (or are sudden hikes like the 2013 case in comparison to planned increases for the following years giving wholesalers time to prepare), customers of all alcohol brands may have a hard time paying up for their favorite drinks.

While Ginebra San Miguel recovered fast, Gran Matador did not and would eventually be rebranded as Primera and Primera Light, making <1% of today’s GSMI portfolio. Management also sold off all non-liquor businesses which at the time comprised about 5% of sales — Ginebra San Miguel would once again become the main brand of the company with >90% of sales volumes and with sales volumes growing about ~8% each year since.

—

Liquor Game of Thrones

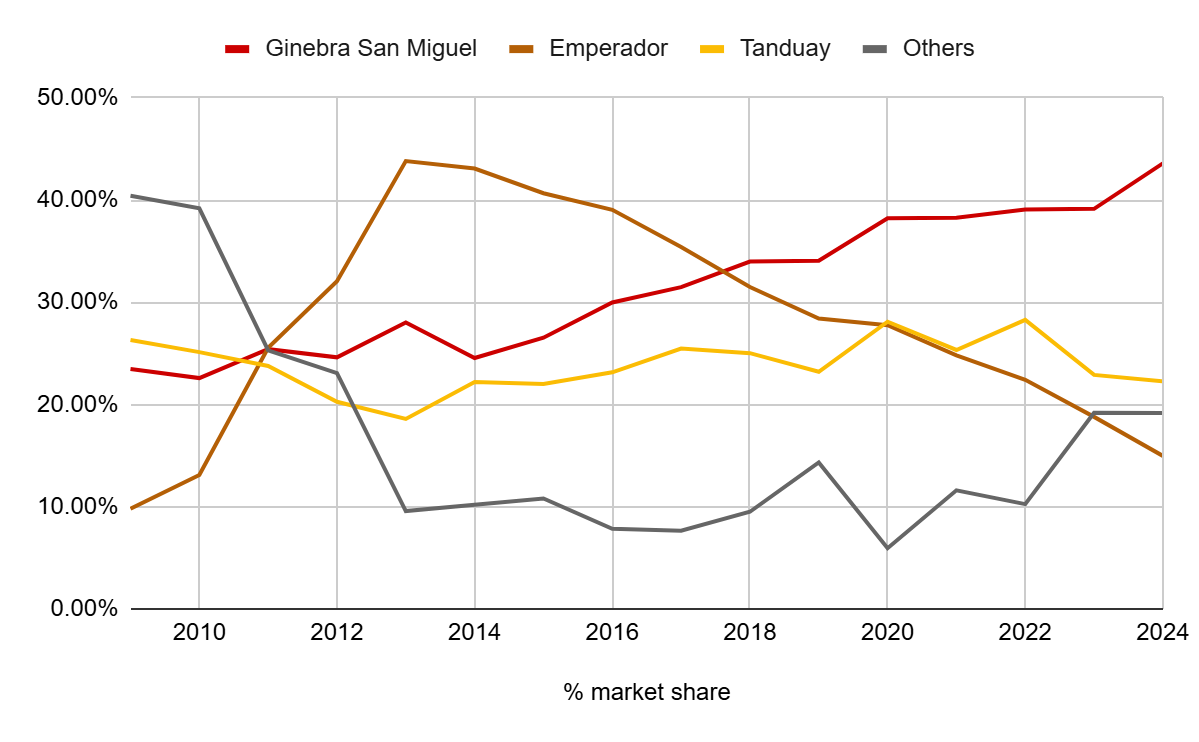

As Ginebra utterly dominates the gin market, the real competition is really substitute liquors. Accounting for just the Ginebra brand, we estimate they control about 44% of the Philippine liquor market in terms of sales volumes in 9L cases. The table below shows our estimates for market share over the years.

Sources: Annual reports, Millionaire’s Club liquor reports, Euromonitor

As you can see, the top three players control about 80% of the market in terms of volume. You can also see that the massive sell-out of Emperador Light was mostly at the expense of smaller brands. Gran Matador would have had approximately 17% of the market in 2009. I attribute the rise in the share of “Others” to:

Growing disposable income have led to an uptick in more upscale brands. The Keepers Inc. is one of the largest importer of European and American brands in the Philippines. Products include Johnny Walker, Pernod, Alfonso, etc. They have close to 10% of the market by value.

Vino Kulafu has reportedly grown well during the pandemic. I estimate they went from 3M cases in 2018 to nearly 6M cases in 2023 and have since subsided. I don’t know what specifically caused this spike, but Vino Kulafu likely now has about 4-6% of total spirit volumes.

There are several reasons why I think Ginebra has been able to continually grow its market share while Tanduay and Emperador have seen less success:

→ Sari-sari stores I contacted have told me Ginebra and San Miguel beer (also owned by parent SMC) outsells all other alcoholic drinks. Will expound more on the distribution network of Ginebra in the next post, but I think utilizing SMC’s massive trade network + marketing channels across the country has been a major driver of Ginebra’s popularity.

→ Because Ginebra is most popular in Metro Manila and Luzon/North (whereas Tanduay is most popular in Visayas/Mid-South), the country’s urbanization and migration of people from the province to city centers has been a huge boon for the company. I actually think Tanduay is GSMI’s biggest hurdle for future geographic expansion as Tanduay simply has better mindshare in Visayas and has a similar century plus long cultural heritage. The angle I see GSMI taking is really leaning into the clear alcohol position and taking out Tanduay White.

→ Though all three are priced almost the same, Ginebra and Tanduay have a long >100+ year history and enjoy deep cultural embeddedness while Emperador only hit the market in the 1990s. While they enjoyed huge popularity with Emperador Light, it seems it just did not stick with wildly shifting consumer preferences, the same factors that killed Gran Matador. Since the mid 2010s, Emperador has seen a major decline in sales and market share. I think one reason for this is the parent company Alliance Global deciding to diversify their liquor business internationally. From 2013-2019, they made several large acquisitions, acquiring big Western brands such as Bodega San Bruno in 2013, Whyte & Mackay for £430M in 2014, Beam Suntory’s brandy business for €275M which came with a basket of brands like Fundador, and Casa Pedro Domecq in 2019, which controlled 57% of the Mexican brandy market. This spread them thin, especially in marketing effort. Meanwhile, GSMI was in the process of concentrating on Ginebra San Miguel, selling off non-liquor assets (they owned some snack businesses before). I will say where Emperador has it good is its popularity for lighter drinkers due to lower ABV. This also means Emperador isn’t as affected by excise taxes. Nevertheless, it seems GM for Emperador’s brandy business and Ginebra has been quite similar at near 25%, which implies the actual Emperador brand drinks have a lower GM than Ginebra as a good chunk of their business is now premium Western brands.

→ As I mentioned, Ginebra’s lead as a clear spirit makes it particularly favored for drink mixing while Emperador and Tanduay are less so (except for Tanduay White, a variant which is a clear rhum). What this means is Ginebra is a mainstay for drink mixing and cocktails, adding, even if a small part of the total business, an extra layer of dominance within b2bar liquor sales.

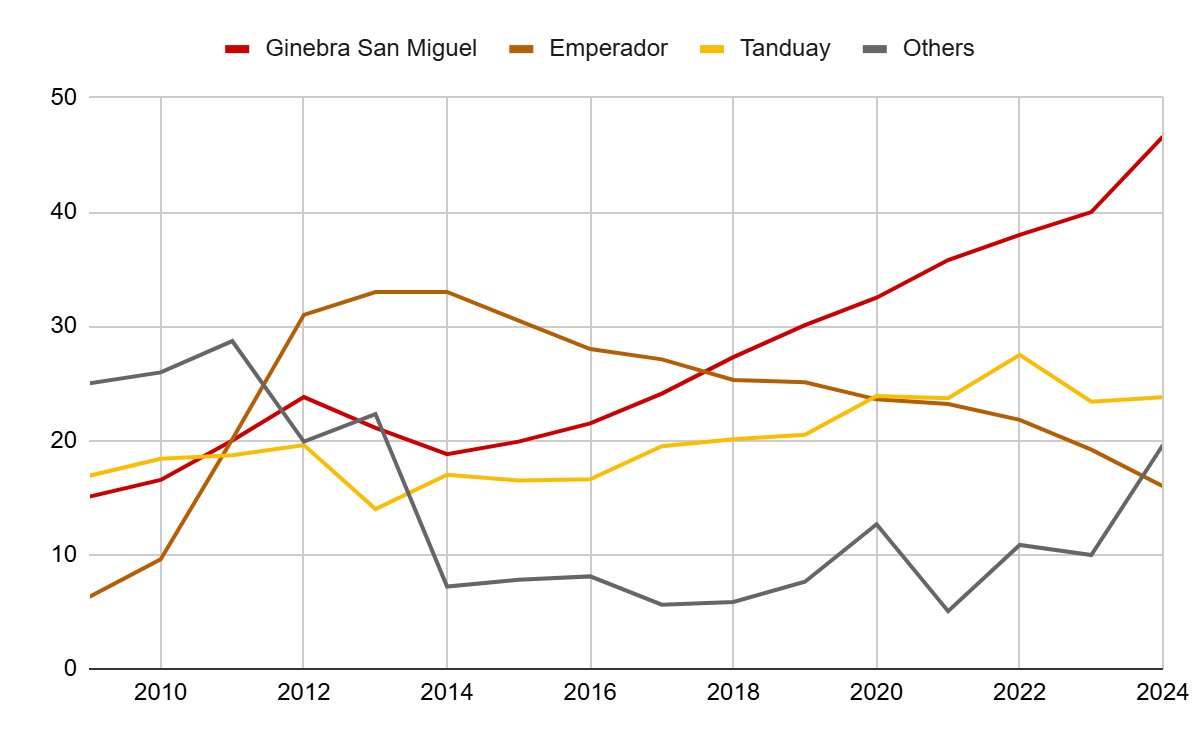

The table below shows 9L case volume sold est.:

Realized this post is way too long so I’ll continue this in the next post. There, I will discuss the distribution network, marketing strategies, management, balance sheet, corporate history, growth runway, and thoughts on valuation.

I’ve been busy with interviews these past couple weeks so the next part will probably come out a bit later.

Subscribe and comment. Thanks.