I wanted to share my thoughts on a company I invested in earlier this year. That company is Lindbergh.

Lindbergh is a small Italian and French logistics company involved in 3 primary types of business:

in-night logistics (80% of revenue) servicing mostly technicians of OEMs, such as those who produce forklifts, elevators, trucks, etc. Lindbergh services primarily include spare parts delivery but may also include spare parts return management, PPE delivery, shared equipment delivery, laundry, and tool testing.

waste disposal services (10% of revenue) that are complimentary to in-night logistics for technicians or in other cases a separate contract. This segment uses the same logistics network as the in-night business.

HVAC installation and maintenance roll-up (5% of revenue) which they started this year and which we think could, alone, be potentially worth over the entire market cap today.

Lindbergh was founded by CEO Michele Corradi and Chairman Marco Pome. The two met as consultants at Steer Davies Gleave in 2003, where they worked on macro-logistics projects, typically for state infrastructure, as well as industrial projects for major companies like Vodaphone. Michele and Marco wanted to continue doing work in industrials, but due to differences with their superiors, the two eventually founded their own consulting firm in 2006.

Slowly, they shifted more and more to waste management, obtaining their waste collection permits in 2008. Lindbergh started to help offer the first in-night logistics services in Italy in 2013 as a consultant of TNT (now owned by FedEx), one of the largest delivery firm in Europe. TNT eventually exited the in-night business due to downsizing and the in-night business being a very very small portion of sales, passing the business to Lindbergh which kept their customer contracts.

Lindbergh expanded to France in 2019 through a JV which Lindbergh eventually acquired majority control of a couple years later. It was also at this time that the T-Linq platform finished development, allowing technicians and customers to control all their logistics needs digitally.

Lindbergh delivered 28M EUR in revenue in 2023, making for a whopping 38% compounded annual growth in the past 4 years.

Financials

Lindbergh has grown sales at an annualized rate of 35% since IPO. Lindbergh has exhibited strong track record with a return on equity >20% every year since IPO on very relatively low debt levels (earnings can pay interest 24x over and equity covers debt). Because the France margins has lower margins (due to lower scale), the expansion caused ebitda margins to decline from 20% to 13%, which is still close to the average for logistics firms. It’s a moderately capital light business. Scale works with order density as you can fill up your trucks and hubs as you get new customers so Lindbergh’s return on assets, currently hovering at 5%, and their margins, should go up as order density improves unit economics.

Why does this opportunity exist?

→ The company trades at around 10x ev/ltm ebitda of about 3M EUR, which we think is a fair price for a wonderful business.

Lindbergh is a micro-cap in Italy. There is almost no sell-side coverage. It’s a boring, dirty, complicated business, and we know how much compounders have come out of the “boring” industrial service/distributor playbook.

Our view is that Lindbergh provides a unique opportunity to own a potential hundred million dollar compounder while it is still a microcap, for these reasons:

Lindbergh provides a mission critical service that massively improves technician productivity characterized by high switching costs and significant cost savings for the customer

Lindbergh operates in niche and complex space often ignored by logistics giants such as DHL and FedEx, leading to virtually no direct competition in Italy and minimal competition in France.

Lindbergh’s cross-selling of other value-added services for technicians in addition to the regular spare parts delivery contracts creates a one-stop shop effect and improves order density which further drives up potential scale advantages.

Lindbergh’s HVAC service roll-up is very promising due to the fact that the Italian HVAC service environment is extremely fragmented. While Lindbergh just started doing this this year, we expect this segment to contribute a sizable chunk of revenue within the next 3-5 years.

Lindbergh has a management team that openly admits mistakes, has immense skin in the game, and are disciplined capital allocators.

Let’s dive in and break down Lindbergh’s value proposition.

Mission critical service

First we need to know what value Lindbergh actually provides to their customers.

Lindbergh charges €20-24 per deliver, which is >33% more expensive than a traditional delivery which would charge €15 per delivery.

Why is Lindbergh more expensive?

OEMs/manufacturers, think elevator, forklift, auto brands keep large amounts of maintenance technicians who are there to serve their end-customers to conduct maintenance, fix, and repair their products.

For example, Jungheinrich, Europe’s largest forklift manufacturer and one of Lindbergh’s longest running customer, would have a large team of technicians, each with their own vans, to help support customers when they need it. Now, technicians require delivery of spare parts when they run out.

This is where Lindbergh comes in.

In a traditional delivery service like DHL, the spare parts are delivered to DHL’s warehouse where the technician must pick it up.

Jungheinrich tells us their process was like this:

“5am - Spare part picked up by DHL from their German warehouse

6pm - Spare part is dropped off at a DHL warehouse and then sent to a Florence connection site

9pm - Spare part is dropped off at the connection site in Florence where the technician has to pick up the item.”

See how time consuming this is…

Lindbergh on the other hand delivers the spare parts inside the van of the technician (yes, they manage a replica key), overnight. This is their flow:

“All spare parts are stored in Lindbergh’s facility rather than Jungheinrich’s own warehouse.

9pm - Spare part is collected by Lindbergh and sent to the technician’s van

7am - By this time, the item is already in the van”

So when the technician enters their van, the part is already inside. No effort, no waste.

This saves the technician about an hour, which is huge considering that the average maintenance technician will cost you €50-60/hour. If you count the €15 per delivery + €10-15/hr (estimate) additional fuel costs for having the technician drive up to the collection site, the OEM saves about €50 per delivery, a nearly 70% cost saving — and remember, technicians need a consistent flow of spare parts, ordering an average of 2-3 parcels each week, meaning customers can’t afford for even a week to stop the delivery of spare parts.

—

Lindbergh thinks of it’s customers as partners. They do this by structuring it’s contracts where customers agree to pay for a set amount of deliveries over a set number of years, typically 2 or more. This creates a lock-in period, establishing a potentially long-term relationship with Lindbergh.

One of the best signs that told us Lindbergh’s in-night solution had high switching costs was the fact that Lindbergh had only lost 1 customer since inception, a small French customer contributing $200k rev, and it was due to the firm’s own cost-cutting measures rather than dissatisfaction with Lindbergh. This represents a retention rate since inception of >95%.

In fact, around half of Lindbergh’s customers have been with them for over 10 years!

So why are switching costs so high?

Implementation process

Setting everything up requires a ton of integration with your technicians, logistics network, and software. From start to finish, the implementation time may take up to one year.

Procuring replica keys: From collecting the keys, to making the replicas, to returning the keys to every technician’s van, this is a long process. These are typically hundreds of employees — and for some, such as a KONE director we spoke with, maintenance technicians are nearly 80% of the workforce in his region. This is the key difference in integration compared with traditional delivery that makes in-night logistics much more sticky.

Onboarding technicians on T-Linq: Technicians tell us T-Linq is quite easy to use; not much of a learning curve. There is still short IT training and data integration that has to be done. It’s a typical on-prem software implementation.

Master data integration: This takes about 20-25 days and includes setting up T-Linq and Lindbergh accounts with the ERP system. For example, Toyota Material Handling called up their IT office in Sweden to set up all the data and ERP.

Pilot program: Typically lasts a few months. This gives a chance for the customer to try out Lindbergh.

Overall, joining Lindbergh is a significant time investment for the company, but it makes a deep integration with their systems, making it very time consuming to switch to another delivery service, as well as a deep relationship with Lindbergh.

We’ve seen this relationship take place when Jungheinrich asked Lindbergh to manage their warehouses. Lindbergh’s response was to create a whole new business unit, which is now 3% of their revenue.

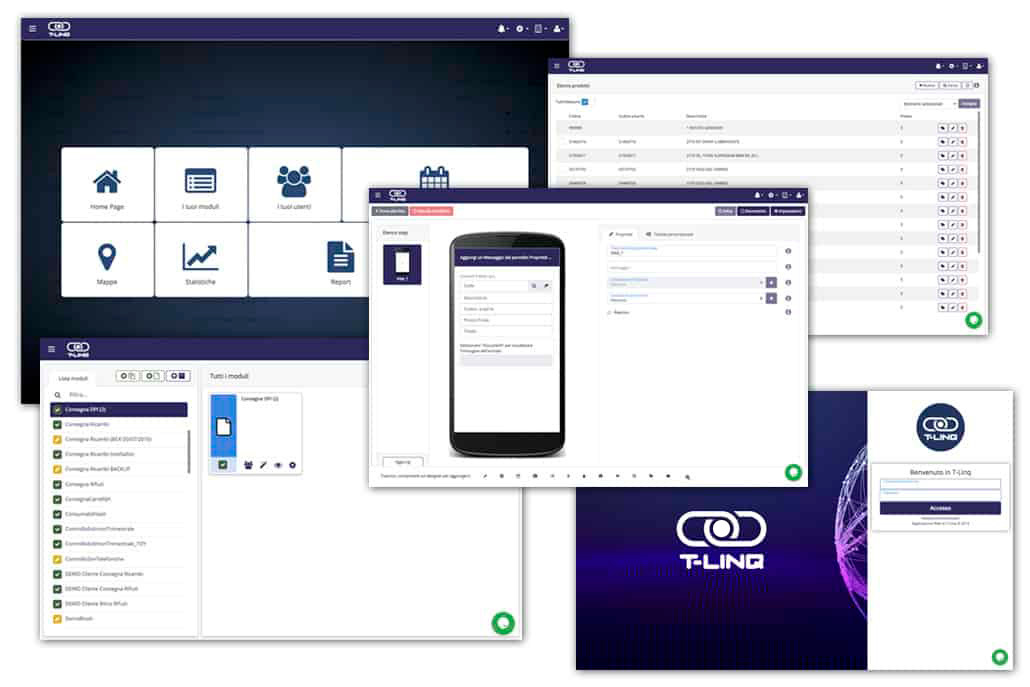

T-Linq platform

The T-Linq platform is an on-prem order flow software created to connect technicians with Lindbergh services all in one place. While the learning curve is small, there are still some switching costs in getting used to how the platform works.

Remember that the software is used by a hundreds of people within an organization. And this is not your typical order and tracking software used by DHL or UPS since it includes a variety of other functions built to serve a team of technicians.

With T-Linq, technicians can order spare parts with the press of a few buttons. T-Linq became extra important with the roll-out of other value added services such as laundry and tool-testing. Now, technicians have access to all these services in one screen where they can book and track services.

T-Linq also provides a shared calendar with the whole team, an alert system for issues and anomalies, documentation and report drafting, and a messaging system with video and picture compatibility. T-Linq is fully customizable: the layout of the apps can be rearranged, and the branding/design can be edited to fit the customer’s preferences.

T-Linq is not just used by the technicians but also the service directors. Service directors can control the number of PPE being requested, which equipment can be used, and can easier track the schedule and flow of technicians and deliveries.

Overall, the platform’s customizability and usage in many parts of the job across organization hierarchy makes it hard for technicians and directors to switch to another delivery provider and having to get used to another kind of software.

Complex space with little direct competition

In Italy, Lindbergh is the only significant in-night logistics player.

Considering the huge cost savings, customer-seller relationships, and stickiness of the business, that begs the question of why haven’t more entered the space? Why haven’t large firms like DHL entered the space?

Customer standpoint:

In-night in-boot delivery took time to be adopted by OEMs. In Italy, many customers were hesitant to give logistics providers key replicas to their vehicles. Furthermore, delivering directly to technician’s vans put the control out of the OEM’s own warehouse management into the logistic provider’s hands, causing fears of inefficiency and untimeliness.

Many firms initially did not understand the cost and benefits of improved technician productivity. Lindbergh’s main point of contact are service managers who man the technician team. The most common case of a failed sale is when the service manager’s proposal is rejected by the finance department or higher ups who don’t focus on the technicians and do not know the costs to that labor as well — so it took time to educate customers and to build the operational capability required to ensure 100% efficiency.

Really the only firms that truly started to adopt overnight delivery was large OEMs. Small local Italian technician teams typically have only 3-4 engineers each who could potentially benefit from in-night delivery. Moreover, these small firms tend to keep to tradition. The hassle of integrating Lindbergh was oftentimes a major drawback. This is why >90% of Lindbergh’s customers are not just large OEMs, not just international OEMs, but German OEMs, who often are more keen on investing in productivity.

Competitor standpoint:

The in-night space was simply too small to really care about. Spare part delivery is just one of many niche in-night delivery verticals which also include medical equipment, uniforms, documents, and auto parts. Furthermore, compared to traditional delivery, in-night delivery typically involves a small amount of deliveries per customer.

The in-night space as a whole paled in comparison to the classic 3PL retail, supply chain, and e-commerce delivery services dominated by the likes of DHL and FedEx. The potential gain from instating in-night delivery is a rounding error to their tens of billions in sales.

Imagine you are DHL and you you had to choose between putting effort to secure a 3PL logistics customer which means making thousands of deliveries every week vs a spare parts technician customer which means making just hundreds of deliveries every week, which would you choose? The large OEMs can provide DHL immense order density on the 3PL side, but not on the in-night delivery side.

That does not mean these bigger players do not delve into in-night delivery. TNT was one of the largest European logistics providers. Before being acquired by FedEx, TNT was one of the early providers of in-night delivery. In Italy, TNT was the only provider of overnight spare parts logistics. They enjoyed some early success with their first major customer, Jungheinrich Italia.

However, following the FedEx acquisition in 2016, TNT was soon forced to sell-off it’s entire overnight delivery arm. It’s Central European segment was sold off to private equity, while it’s Italian operations were discontinued, giving Lindbergh the opportunity to grab the market for themselves.

Why did TNT let go of the segment? It’s because the overnight delivery arm was so small that it comprised <1% of TNT’s turnover. In Italy, overnight delivery was just €2M in sales compared to the €400M for the entire business. As TNT made an effort to centralize it’s CapEx on core businesses, overnight was naturally turned a blind eye and eventually dropped from the company.

→ It’s also important to know that developing overnight logistics is much harder than traditional logistics

As we’ve mentioned multiple times, making key replicas is a time-consuming and relatively costly task. The act of even getting the keys from all the technicians is a bloody operation.

Because in-night in-boot delivery requires spare parts to be delivered directly to the van, you need software to optimize the delivery route. Lindbergh had to develop this technology to do this whereas traditional delivery services only have to send the parcels to a small fixed number of locations

Waste Management

Lindbergh collects waste from technician’s van overnight, properly disposing it in their waste collection sites in accordance with regulation.

Previously, technicians would have to bring their waste back to the company’s hubs where the OEM would have to dispose it themselves via the large waste management providers.

Again, similar to spare parts delivery, this is a mission critical activity as technicians need to dispose their waste to abide by the stringent EU waste regulation.

Again, Lindbergh’s service saves a lot of time by not having to drive all the way to the OEM’s hub to drop off the waste. This comes at a very efficient cost too: when customers use Lindbergh’s spare parts, they can add on the waste management for cheaper, leading to a €30 price per delivery for both the part drop-off and the waste pickup, meaning for each waste pick-up, you just pay an extra €5.

Again, technician micro waste collection is paid no attention by the large traditional waste providers. Overnight waste collection and disposal is a mere fraction of these what these firms take care of in a day.

Again, most of these traditional waste management firms use a intuitive platform and routing software like Lindbergh. In fact, a lot of Italian waste documentation is still paper-based.

The main barrier to entry here is that getting waste disposal certification in the EU is a pain in the ass. It took Lindbergh nearly 3 years to get a waste disposal permit just for Milan.

Like spare parts delivery, waste management is a complex, dirty, niche business that not only has the customer advantage to create long-term growth but also further improves the order density for Lindbergh trucks deepening the cost-savings.

Sun Mountain Partners, investors in Lindbergh (Chris Solberg is a seasoned investor who won a major Buffet case competition while William Thorndike wrote The Outsiders, an essential read on great management) put it like this:

“Think of the difference between Lindbergh’s model and the standard couriers’ and waste managers’ as low volume, high complexity, high cost per unit versus high volume, low complexity, low cost per unit.”

—

In the next posts, we will discuss how Lindbergh is winning in France, how their other higher margin delivery services are improving their order density, and how Lindbergh is building a new and promising HVAC rollup that could be worth the entire market cap of the company today!

Disclaimer: This is NOT investment advice. All content on this website is for informational and educational purposes only and should not be considered to be advice of any nature. Due your own due diligence.

Thanks for the writeup! What other ancillary services could Ldb provide to raise unit Econ. Also, for the HVAC segment, what's the Ave. win rate vs peers?