Before we begin, if you enjoy this content and wish to be updated on future research, subscribe below.

Thank you!

—

Cintas - a brief case study

Cintas is an American uniform rental company that is a must-read case study for any route-based business.

Cintas was started in Ohio during Great Depression by a circus couple who noticed factory workers used rags which would be thrown away after a while. They would collect them, clean them, and resell them as brand new.

By the 60s, Cintas was doing uniform rentals and was being managed by Richard Farmer, the grandson of the founding couple. Cintas worked mostly with hotels, restaurants, and mechanics. Instead of having to purchase uniforms, clean it themselves, maintain them, and replace it themselves, Cintas allowed you to rent uniforms for about a couple bucks per day per employee and Cintas takes care of everything for them. Customers have less to think about, allowing them to just focus on their business.

This was a mission critical service for many customers in sectors requiring complete cleanliness of work-wear. Factories and hospitals cannot have a single contaminant enter their workplace. And Cintas, due to economies of scale, could do this a lot cheaper than what customers would be able to do themselves.

Overtime, Cintas expanded into other services that the customer could use such as uniform and outfit laundry, supplying kitchen and bathroom supplies, supplying rags and towels, delivering first aid kits, conducting on-site safety inspection, on-site fire inspection, and deep cleaning. These facility services make up nearly half of the company’s total revenue.

Via a series of disciplined tuck-in acquisition, Cintas took out its competitors. Now, Cintas is the number 1 uniform rental player with a roughly 40% market share. The number 2 and 3 players, Aramark and UniFirst, have a vastly inferior 14 and 12% respectively. Nearly half the country still insource their uniform services, leaving a long growth runway for even the largest players in the space. Cintas boasts an impressive 20% return on operating assets.

Cintas shares are now worth $77 billion and has delivered 25% compounded annual return for the past 15 years, a return higher than Berkshire Hathaway. But how could a boring simple uniform rental business deliver better returns than Microsoft, Facebook, and Google?

Order density → for a route-based business — transportation, warehouse management, and labor is fixed to the extent that your trucks and hubs reach full capacity. This means the more parcels you can fit in your truck and warehouse, the cheaper the per unit cost to deliver it becomes, thus achieves a scale advantage which generates cost savings that can then be used to undercut competitors on price. More deliveries in one route also achieves greater turnover on a similar amount of fuel and labor expense. Cintas achieved their dominant scale position by offering various related services so that each truck could deliver a lot more parcels to a single customer and simply acquiring more customers so that each truck has more to deliver each ride. This makes it harder for competitors to undercut Cintas on price.

One-stop shop effect → a common strategy in many great distributor businesses. Businesses typically prefer to get most of what they need from one supplier versus having to manage accounts from multiple suppliers. By offering various related services aside from just uniform rentals, Cintas becomes a one-stop shop for customers where they their kitchen, bathroom, cleaning, and inspection services can all be managed in one account. This achieves 2 things: 1) customers prefer Cintas over smaller players who only have the scale and expertise in one line business, and 2) with this much services attached to one company, Cintas becomes more integrated into their customer’s operations, raising the switching costs. In fact, Cintas has a 96% retention rate, typically locking them in contracts spanning over 3 years.

Roll-up acquisitions → As analysts said about Cintas: “In good economic times, uniform companies grow by increasing the size of existing accounts and convincing companies that have never rented workers’ uniforms that it’s cost-efficient and enhances their corporate image, says analyst Jim Stoeffel of Smith Barney. In bad times, the big companies grow more through acquisition, because more of the 700 or so small uniform-rental companies become willing to sell their businesses for lower prices, says analyst Craig.” Cintas has operated with minimal debt, allowing it to make investments during both up and down cycles, acquiring companies at multiple lower than what they were trading at, slowly and quietly kicking out competition. We will see that because there’s not a lot of small in-night delivery players, there’s not much utility to Lindbergh doing the same roll-up in logistics.

Corporate culture → Cintas came from a humble environment and management remains humble to date. Management has consistently been transparent about their mistakes, and ensures their employees are too. Every employee is required to read a book written by Richard Farmer detailing the values of honesty and integrity required to work at Cintas. Executives are long-term focused as well, which in 1979 they laid out their principal objective of “exceeding our customers’ expectations to maximizing the long-term value of Cintas for its shareholders and working partners.”

As you have and will continue to see, Lindbergh is trying to follow the Cintas playbook.

—

Value-added technician services — creating a one-stop shop effect

The key differentiator between Lindbergh and all of traditional and in-night delivery services is that Lindbergh thinks in terms of revenue per technician, not number of deliveries. It’s this mindset that we believe gives Lindbergh their competitive advantages.

By thinking about how better they can serve the technician, Lindbergh has expanded into multiple value-added services other spare parts delivery providers have not. These include:

waste management, as we’ve already discussed in Lindbergh - part 1.

tool testing - Lindbergh picks up the technician’s tools which require periodic maintenance checks to meet quality regulation. They test the tool in to ensure there are no quality changes and that the power range complies with regulation. Adding a tool testing to your spare parts delivery adds up to +€18/tool.

protective equipment - Lindbergh supplies technicians with gloves, overalls, shoes, equipment, and accessories directly into the van. Lindbergh has an online catalogue with around 40 items that can be accessed on T-Linq. With scale, Lindbergh can negotiate better prices from its PPE suppliers. This segment alone generated >€500k last year.

equipment delivery - Lindbergh delivers can deliver equipment from the OEM warehouse to the technician’s van.

spare parts return - Lindbergh picks up an unusable spare part from the van and return it to the OEM’s warehouse or repair center.

clothing repair and laundry - Lindbergh picks up the technician’s outfit, cleans it and fixes any damages, and returns it to the technician’s van.

shared equipment delivery - Lindbergh collects equipment from the OEM’s warehouse and sends to the van of the technician.

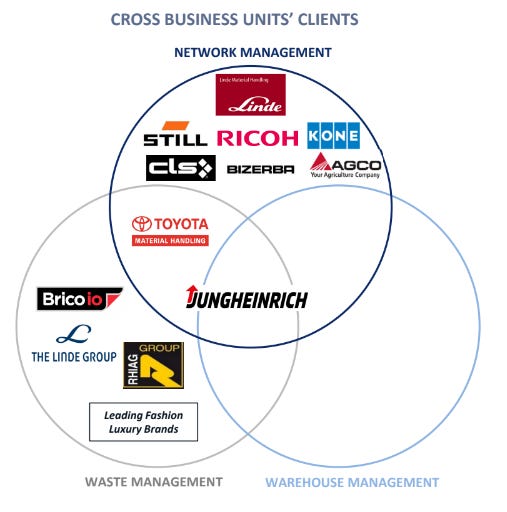

warehouse management - started with Jungheinrich which requested Lindbergh to manage their forklift warehouses. Lindbergh delivers the product, manages the warehouse, and maintains the inventory.

The addition of all these services helps both the customer and Lindbergh.

For the customer, when using multiple services in addition to the spare parts delivery, could save hours. Previously, technicians had to drive to the OEM’s headquarters to dispose their waste, collect new equipment, and return spare parts. Technicians had go to a separate shop for repairing or laundering their clothes. Technicians had to spend time doing maintenance checks on their tools. OEMs had to spend time finding and purchasing protective equipment.

Why use another in-night spare parts provider and do all these tasks separately when you can have 1 account on Lindbergh where you can request for all these activities in 1 platform. This removes hassle, and more importantly, saves precious time that would have been expensed as labor costs for the technician.

For Lindbergh, these services increase order density. In fact, all these value added services aside from warehouse management contribute >50% of in-night delivery turnover (abt 48% for spare parts delivery).

The order density can be broken into two scale economies:

More stops to deliver per ride - with a larger variety of services, Lindbergh is guaranteed to have more stops compared to just spare parts delivery on the same fuel and labor cost.

More to deliver per stop - with a larger variety of services, Lindbergh has a higher chance of delivering more parcels per stop. This increases the utilization of the vehicle spread across the same fuel and labor cost. This is less significant than the first point because at some point, you will need to get more trucks when your current capacity gets fully utilized.

Since 2020 when these ancillary services were introduced, average monthly revenue per technician has gone up from about €180/technician to over €370/technician in Italy. The order density should have increased about 2x! This has increased return on operating assets, which now stand at a strong 15%.

While most customers use at least 2 Lindbergh services, we expect further cross-selling and integration to increase this, further improving order density. Moreover, the amount of possible services that Lindbergh could offer is nearly endless. Lindbergh could provide van inspection, first aid, sanitation materials, and more.

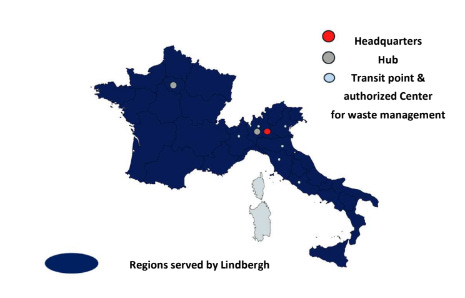

France

Lindbergh expanded to France in 2021, a was the primary reason they went public. France now contributes 40% of sales to Lindbergh.

The French logistics space is a different story compared to Italy.

The French space barely provides the value-added services available to Italy, so Lindbergh France primarily deals in spare parts delivery and waste management. This has led to a much smaller revenue per technician of about €170/technician. Yet the French segment already serves over 5000 technicians compared to the >2000 served in Italy. This is because 1) France is generally a larger market for large OEMs with typically over 2x the amount of engineers in France vs Italy, and 2) because Lindbergh already had strong relationships with multinational OEMs in Italy, it found no problem getting their French technicians onboard.

You also have a much larger proportion of waste management customers. Lindbergh’s largest customer in France is LVMH. Again, the LVMH story of choosing Lindbergh is similar to what we discussed:

Before using Lindbergh, LVMH used various local partners around France to dispose their waste. These local waste disposal services did not have any material recovery capabilities.

With Lindbergh, LVMH could track all their waste disposal on a centralized platform, allowing for more efficient data management.

With Lindbergh, LVMH doesn’t have to deal with so many accounts and suppliers. They can handle everything on a national level.

With Lindbergh, waste can be recycled and some can be recovered, saving LVMH on costs.

But while the French segment looks very promising, there are some issues:

→ The French segment is not very profitable yet. In fact, as of 2023, it’s just breakeven compared to the 20% ebitda margin enjoyed by the Italian segment (remember, industry average ebitda margin for logistics in 10-12%). This led to total ebitda margins declining to 13% as of 2023.

→ Cultural and language barriers caused road bumps for the Lindbergh team to set up a sales network.

→ Because the French segment was losing money initially, Lindbergh resorted to outsourcing drivers, while this increased profitability, it does lead to control and quality issues.

→ The competition in France is small but more developed than in Italy. There are a couple of large European logistics firms that offer in-night spare parts delivery.

One of these is Sterne. Sterne offers both traditional and in-night delivery for a variety of niches. Still, in-night spare parts delivery is reportedly <1% of total sales. Sterne was formerly the top in-night player in France, but according to management, Sterne now controls just 25% of in-night spare parts delivery space in France.

Another is Ciblex. Like Sterne, Ciblex is a large logistics firm involved in both traditional and in-night delivery in a variety of niches. Ciblex is a much smaller competitor which we estimate holds <5% of the market.

Once again, we see the case where large logistics firms cast a wide net, and as a result, are not able to focus on competition within a small niche.

Chats with large national logistics firms from other European countries confirm this. The Swiss Post, for example, has an in-night delivery segment, but it only comprises <0.5% of revenue. Again, they do all kinds of niche delivery from healthcare to auto parts. They are not able to think in revenue per technician because they are inherently a volume-centric business.

Lindbergh now likely controls over half the in-night spare parts delivery space simply due to the adoption of their major OEM clients they had while they were just in Italy. As Lindbergh eventually rolls out the value-added services, we expect this differentiation to enable Lindbergh to control majority of the market.

Overall, the French market is Lindbergh’s key area of growth. Despite already making 30% more volume in France compared to Italy, the market is arguably 2-300% larger. The only issues is profitability and scale, which we think Lindbergh could improve on over the next few years.

Growth Runway

How much market is there left for Lindbergh to penetrate?

Lindbergh has roughly 7500 technicians using their service. 5300 in France and 2200 in Italy.

In Italy, there are about 90-100,000 maintenance technicians that could potentially use Lindbergh. This means total penetration is just 2-3%.

In France, there is probably about 250-300,000 maintenance technicians, with about 600-700,000 engineering technicians in total across the country. This means total penetration is also about 2%.

As you can tell, the total addressable market is huge!

In Italy, the main source of growth will come from more OEMs and technicians adopting in-night delivery, switching from traditional delivery like DHL which dominate the industry.

In France, the main source of growth will come from mostly from adoption but possibly from customers acquired from Sterne.

Key risks

While this means Lindbergh has plenty of room to grow, it also provide a gap for new entrants to establish themselves. Lindbergh is still a small company and has not established enough order density and scale economies to be completely defendable against new entrants.

There is also the risk of larger logistics companies focusing more on the technician in-night delivery niche. While this is possible, as we’ve discussed, this is unlikely as the market for this is incredibly small compared to the traditional delivery market. Even if DHL enters in-night delivery, they will need separate training, better IT integration, a key management system, waste certification, and capabilities for other ancillary services outside the typical logistics activities.

Finally, there is a key person risk — In the next and last Lindbergh post, we will discuss our thoughts on management, their culture, and capital allocation skills, and we will see how important Michele, Marco, and the rest of the team is in making Lindbergh succeed.

—

Disclaimer: This is NOT investment advice. All content on this website is for informational and educational purposes only and should not be considered to be advice of any nature. Due your own due diligence.