Disclaimer: The following write-up is no investment advice. The author may own, buy, and sell securities mentioned in this post. Please do your own due diligence.

To those who read part 1, thank you for waiting. I just graduated and spent some time with family over the past couple weeks. On top of that, I’ve been trying to start a business.

Thanks for your support as always!

—

Competition

Property Databank competes with horizontal solutions such as Excel and ERP systems like OBIC as well as a variety of property management vertical software products.

Our channel checks indicate T2TR as ‘@property’s primary property management software competitor. The main difference between T2TR and ‘@property’ is that ‘@property’ covers a wide range of property management tasks, though specing more into maintenance, while T2TR focuses more on the fund management side focusing on features such as financial data, fund reporting, and forecasts, but is lacking severely in facility management. Hence, T2TR is extremely popular among investment managers and REITs, with 80% of J-REITs and private REITs using the system. Many REITs actually use both T2TR and ‘@property’, using the former for financial metrics (e.g. NOI, FFO calculation, forecasting) and ‘@property’ for daily operations and everything else. It’s important to note that T2TR charges based on fund size/AUM while ‘@property’ charges on building count, so pricing is not exactly comparable. Both rely mostly on inbound and general market presence.

I think T2TR does not pose a serious threat as their products seem to focus on different things. Moreover, ‘@property’ is dominant in maintenance, which I think is the chokepoint while simultaneously enjoying a richer product feature set. However, T2TR will be an obstacle for ‘@property’ in getting their customers to adopt ‘@property’s asset management features.

Probably the largest competitor PDB competes with is OBIC7, OBIC’s flagship ERP solution that commands a larger market larger than the next two competitors put together. OBIC7 is customized to specific client needs, which allows it to cater to property managers which have property-related accounting and operational metrics. As OBIC has been dominant in the market for so long, there is a switching cost customers must overcome to switch completely over to ‘@property’.

Overall, it seems that the operations and real estate people prefer ‘@property’, the finance/IR people prefer T2TR, and the accounting people prefer OBIC7. I think PDB is kinda unique in the sense that as their capabilities are so vast, they don’t 100% directly compete with any one player, each choosing to focus on a different region of property management, unlike other competitive dynamics where it really is a race to have the most and best features (See Plus Alpha Consulting vs Kaonavi)

There’s plenty of whitespace open for the taking. ‘@property’s feature depth and control of the chokepoint should protect it from losing its dominance in the coming future.

—

Management

PDB has 22% insider ownership. Co-founder and Chairman Toshimasa Itaya owns 9.4% while co-founder and CEO Hideki Takashi owns 6.5%.

The largest shareholder is partner Shimizu Corporation, Takashi and Itaya’s former employers, who own close to 25% of the company. They have not changed their position since IPO.

The next largest shareholder is Ken Corporation which owns 12.5% of PDB. Ken Corporation is a property management company that handles rental, sale, management, and brokerage of high-end rental apartments, houses, and offices. They manage close to ¥260B in property. Ken Corporation was one of PDB’s first big investors, and have maintained their 12.5% stake since IPO.

The third large shareholder is investment firm Hikari Tunshin, a holding/investment company that has generated an above 15% IRR for nearly a decade. They are commonly compared to Berkshire Hathaway, and management have indicated that they are value investors. Hikari acquired 7% of PDB is 2024 and has since increased its stake to over 12%. Though due to PDB’s size, it remains a miniscule position in their trillion yen portfolio.

Overall, a healthy insider ownership and seemingly confident corporate investor base.

Management has been conservative with capital allocation like many other Japanese cos: no debt, dividends over stock repurchases, large cash balance. Cash is mostly spent on capitalized software expenses.

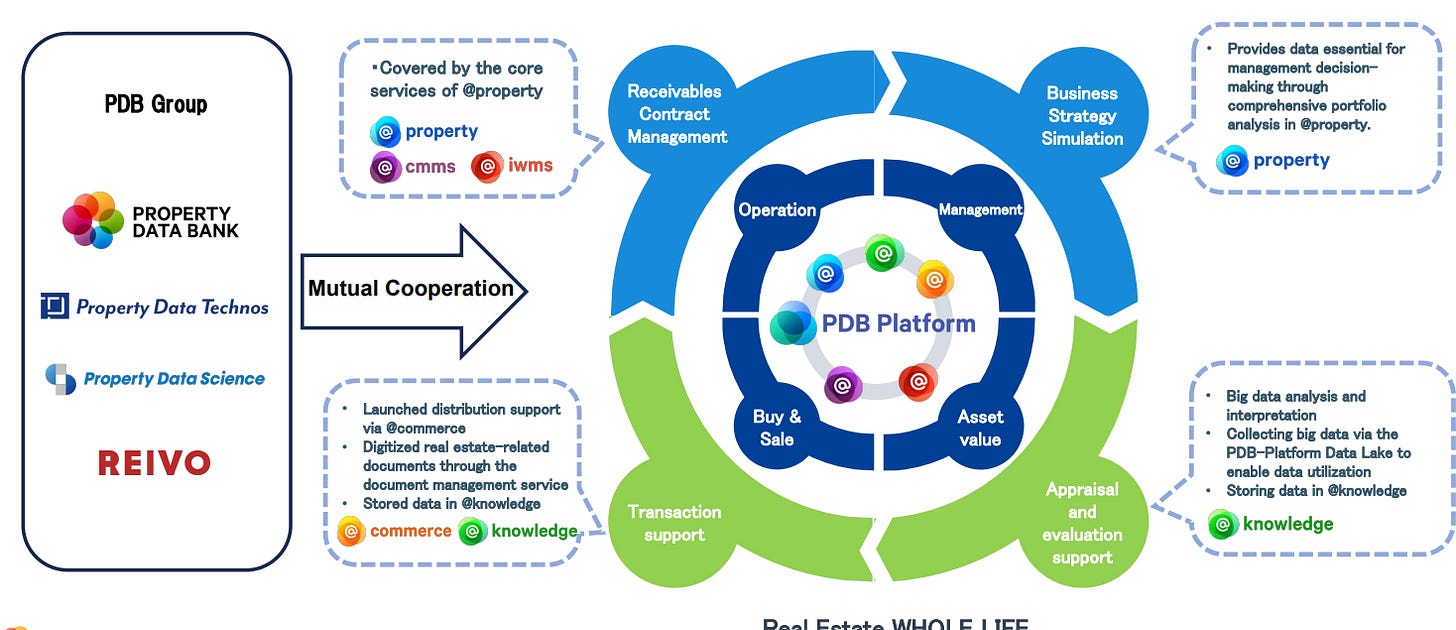

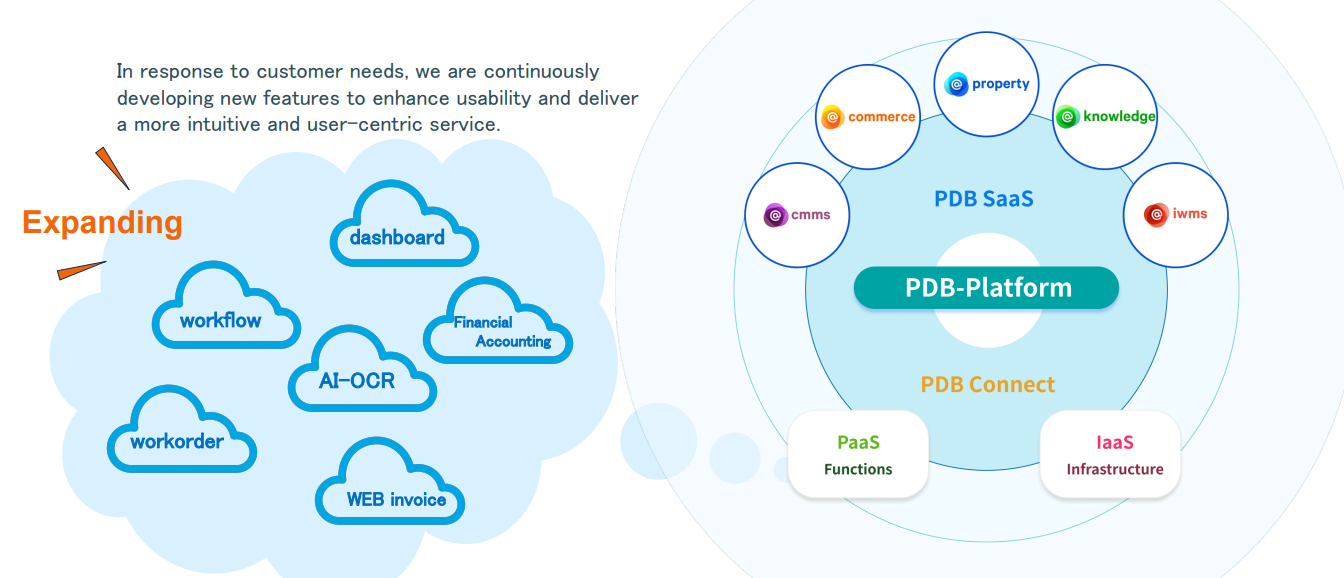

Feature roll-out has recently been focused on expanding the other ‘@’ products, end-to-end transactions/tenant portals, and utilizing its huge dataset to expand into appraisal and evaluation. The company is also building out AI features, such as features that allow users to extract information from receipts and lease documents, AI data analysis features, and AI customer support bots.

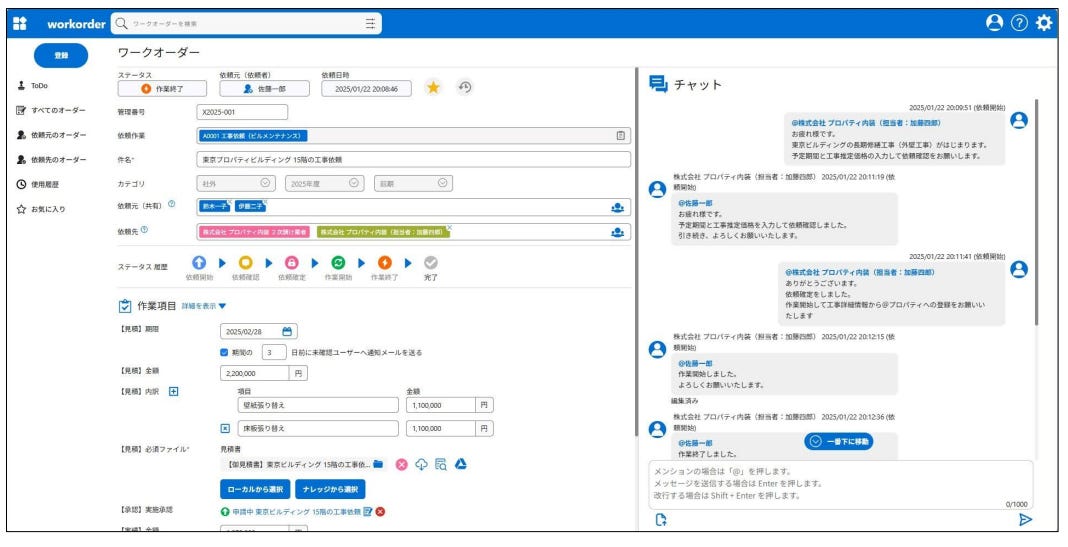

Management has expressed interest in doing M&A. They acquired Reivo in 2024 (8x operating income) to improve their technical talent in mobile app development. We can see concentrated effort to improve UX/UI from their outdated look. This is especially apparent in their newer and add-on products:

It’s also interesting to note that PDB hosts their own private cloud servers via internal data centers rather than outsource to AWS/Azure. This provides control over the database and reduces costs, though it presents larger operational risk as they have to manage their own infrastructure. Management plans to offer IaaS products, called Data Lake, to other system integrators working with customers in the real estate space, though I’m skeptical of how they will fare in that front.

—

There are some concerns I have with management and the business.

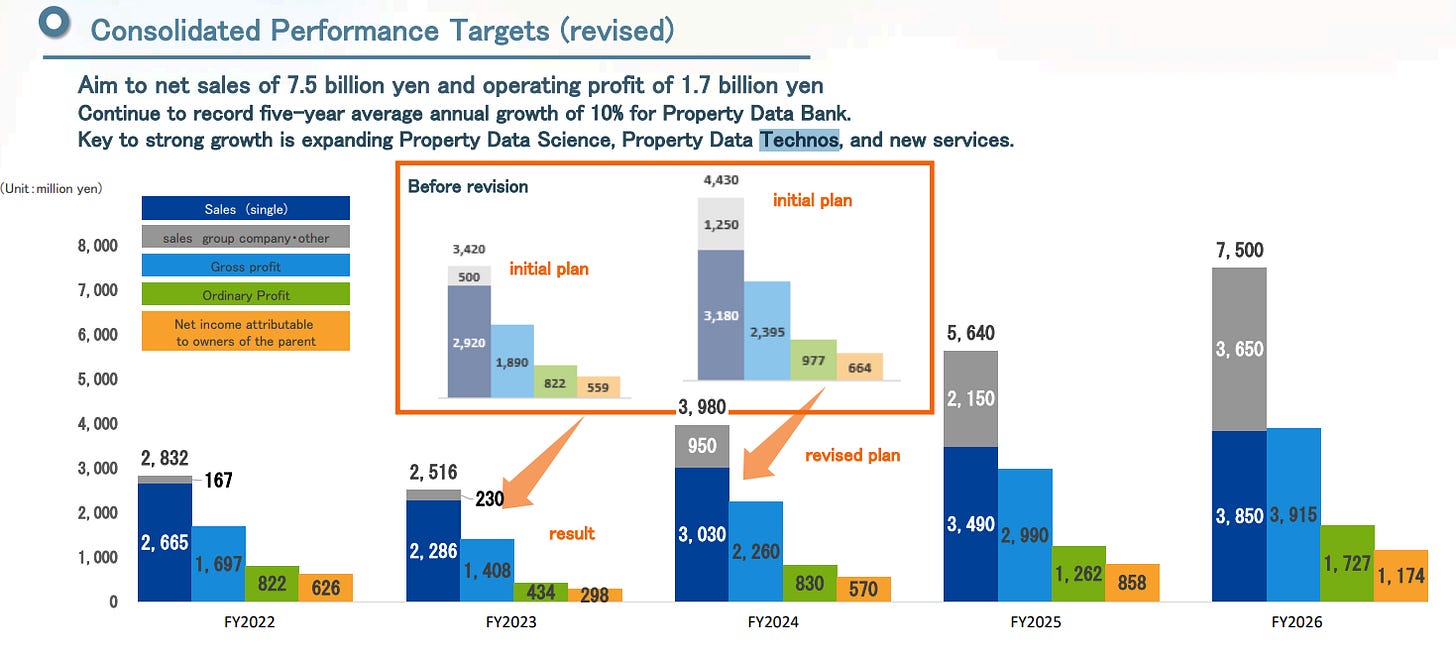

One is that management is overpromising regarding mid-term and long-term guidance. Management is targeting ¥7.5B in sales by 2027, close to half of which is banking on the growth of their new businesses (grey bar).

Property Data Technos was started in 2022 to provide BPO and document management services to their clients. Growth in this business has been muted, slower than what management has expected.

Property Data Science, also started in 2022, arose to provide products to their retail customer base. ‘@commerce’ was the subsidiary’s first major product, released in 2023. Now they’ve expanded into customer support, releasing Speed Answer, a software product for lead and call management.

“Other” includes newer modules such as ‘@knowledge’ and ‘@iwms’ that expand usage outside the ‘@property’ functions though they are highly interconnected, as well as acquisitions.

I sincerely doubt Property Databank will be able to achieve their mid-term guidance.

We already saw historically how project delays in the service business, accounted for under percentage-to-completion method, leads to severely volatile earnings recognition, which leads to either exceeding expectations or hugely missing them, as they did in 2023; projects which are becoming larger and larger, which can be at bigger risk of schedule delays.

Nevertheless, many software companies have successfully doubled or tripled sales simply by cross-selling new businesses to existing clients (such as Appfolio). Ergo, I am not discounting this completely.

The investor may find be turned off by this dynamic, in a Japanese market that is hyper-focused on meeting projections. However, the earnings power and growth runway of the core business is so large I do not think of this as long-term risk. Additionally, if the market was confident management would hit ¥7.5B in sales by 2026, then the stock would be trading at close to 1x forward revenue, which is downright absurd. I think the market is already cognizant of the fact that the mid-term guidance figures is a nothing-burger.

The volatility of service profit margins (btw, there is no breakdown of the segments, which has been a black box for investors, though management has confirmed the service business has lower margins than the cloud business) leads to:

More buying opportunities when Mr. Market unfairly discounts Property Databank simply because contract performance is delayed.

Overtime, the consistency and growth consistency of the cloud business will lead to a generally higher % of operating profit coming from said segment, so it will have far higher significance to the market, diminishing stock movement due to short-term uncertainty.

Again, we have a case of a focus on short and mid-term uncertainty over long-term earnings quality.

—

Valuation

At 6x EBITDA, 9x FCF, <3x sales (2024 figures), PDB is a great business at a fair price.

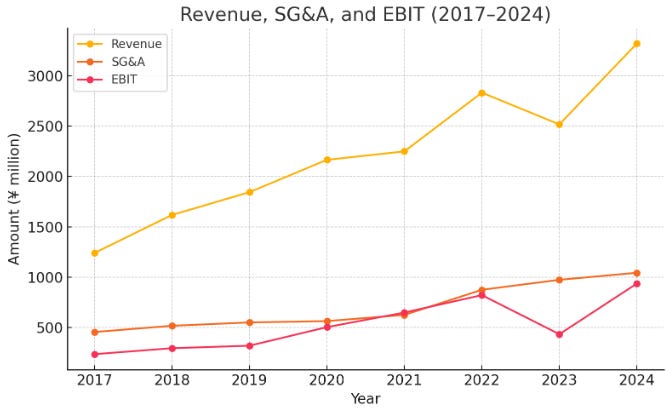

You can say the pandemic was a major catalyst for PDB. In 2017-2018, margins were in the teens level, service sales jumped to >40% of the total while the cloud segment was growth 5-7%. During and after the pandemic however, sales were growing above 8%, with a near 20% spike in 2020 alone while service sales continued to grow. Furthermore, margins significantly improved: operating margins jumped to 23% in 2020 and 29% in 2021, EBITDA margins reached close to 40% by 2022.

According to management, profit margin increases have been mainly driven by operating leverage as the growth in cloud sales cost relatively little increase in SG&A. Again, I’ll mention that the company has no debt and ROE has maintained 17% since the pandemic with the exception of 2023.

Overall, a teens profit growth and near 10% revenue growth in the mid-term is a reasonable assumption.

The service segment definitely warrants a lower multiple, probably 6-8x operating profit after taxes. I would have designated it lower due to the poor margins and unpredictability of earnings, but the service segment is clearly growing with bigger and bigger projects over the years. In fact, service sales have grown >20% since 2017.

On the other hand, I think the core cloud business definitely warrants a mid-high teens multiple on earnings after taxes considering a potentially gigantic terminal value coming from consistent and predictable earnings growth and immense runway — I think 16-18x makes sense.

If you assume cloud solutions make up around 80% of earnings, then 15x is fair if you assume only little contribution from their new modules and segments. Though at 9x FCF and 2.6x revenue, this is generally cheap for SaaS (remember that Appfolio trades at 40x earnings).

Assuming a stagnant multiple, stable business, and new segments fail, I’m comfortable in estimating an IRR of 15%. If indeed the cross-sold modules significantly increases ARPU and switching cost however, this would lead to not just increase profit growth but a valuation re-rate, at which point a >30% IRR can be entertained.

—

The conclusion is that Property Databank is a classic near-monopoly vertical software business. If you think that Property Databank will remain the dominant property and asset cloud solution over the long term, the sheer pricing power combined with operating leverage will no doubt reward the patient investor with immense terminal value.

—

If you’re interested, I’d love to see you on Twitter. Every like, follow, and share is extremely appreciated.

If you’d like to learn more about vertical software, check out my other post on this.

Thank you.