Disclosure: I own shares of GSMI. This is not investment advice, please do your own due diligence.

Ginebra trades at 10x 2025E after-tax earnings, 9x 2025E FCF while generating returns on invested capital above 50% (check part 1 again for my ROIC calculations). After-tax profits have grown at >30% for the past 5 years

Meanwhile Emperador, a business which is far worse as I’ve extensively explained, trades at 40 times 2025E after-tax earnings!

I believe Ginebra deserves a price to earnings of at least 20x. And you get 5% dividend yield for waiting.

Even if I had $10 billion dollars, I doubt I could cause a dent in Ginebra’s business. Both Tanduay and Emperador have launched gin brands before with grand campaigns but this did not do anything to Ginebra’s market share.

Many have tried, all have failed.

As I mentioned in Part 1, mass-market liquors like Ginebra depend heavily on sari-sari stores where most of the end-customers buy from. These are small convenience stores scattered across the country, especially in urban areas, that allow you to buy bits of everything from snacks to toothpaste to of course, alcohol.

There are about 1.3 million of these stores. For reference, the US only has 152,000 convenience stores.

This means 1) an extremely fragmented customer base which gives you and your distributors more negotiating power, but it also means 2) you need both extensive logistics capabilities and customer relationships (or lots of accounts with customer relationships). I think Ginebra, through their parent SMC, has probably the most extensive distribution network in the country due to SMC’s cross-island and nationwide warehouse and route network as well as having a large account base that are able to cater to most sari-sari stores in the country.

I will first go over the supply chain and distribution of Ginebra and then discuss their marketing strategies, such as their basketball team (yes they have a basketball team) and then thoughts on management.

Production

GSMI is like many other liquor firms in the Philippines: owning a portion of the distillation process as well as all of the bottling process, same with Emperador and Tanduay. Unlike a business like Coca-Cola, covering the bottling process requires far more CapEx. Capacity increases are inevitable as sales volumes grow. For Ginebra’s case, they own one of Asia’s largest distilleries which has no doubt allowed them to achieve immense sacle and they expanded facilities already in 2021 for $110 million. In 2024, there was about a billion pesos est spent in growth CapEx on capital projects, likely to increase capacity to facilitate volume growth.

Let’s go over the Ginebra production process from feedstock to bottle.

Ginebra sources 38% of its alcohol internally via its subsidiary Distileria Bago. Molasses are first purchased from sugar mills in the Philippines, India, and Indonesia, which are then sent to Bago’s distillery to convert to alcohol. The rest are sourced internationally, a deliberate move to diversify supplier base. They tried producing alcohol from alternatives such as cassava starch in 2001 but it seems this didn’t stick. Byproducts like wastewater and technical alcohol are sold off.

The distilled alcohol is then sent to the bottling plants. About 2/3 of bottles are sourced from their second-hand retrieval program. The other 1/3 are produced by San Miguel Yamamura, San Miguel’s packaging arm for its beverages. Flavouring is made with extra sugar purchased locally and flavouring agents imported from various Asia-Pacific traders.

The company owns 6 bottling plants mostly in Luzon and Visayas: 3 via the main company in Mandaue City, Cebu (mid-Visayas); Sta. Barbara, Pangasinan (north-Luzon) ; and Cabuyao, Laguna (center-Luzon) and 2 via East Star Pacific Bottlers in Cauayan, Isabela (north-Luzon) and in Ligao City, Albay (south-Luzon). They acquired East Star in 2012 to expand bottling capacity for $5M USD.

Having some of the largest distilling and bottling facilities in the country plus the largest sales volumes leads to supreme economies of scale. I believe these scale advantages are what allow GSMI to achieve better gross margins compared to Emperador and Tanduay despite all three brands charging almost the same price per ml.

→ This is especially the case for Emperador who not only has a significant mix of premium higher margin brands but who also pays far lower excise taxes due to the lower alcohol levels compared to a bottle of Ginebra. In fact, each Emperador bottle would have a bit less than 40% of its price in excise taxes while excise taxes make up nearly 50% for each Ginebra bottle. Excise taxes make up close to 60% of Ginebra’s cost of sales. This implies the Emperador brand has a far poorer cost structure. Emperador’s brandy segment had a GM of 21% in 2024 compared to GSMI’s 24%.

→ Tanduay achieved a GM of 15% in 2024 (note: Tanduay, Emperador, and Ginebra all use weighted average cost for inventory calculation). They have a similar ABV to Ginebra and should have a similar excise tax. Therefore, it has nothing to do with the taxes and everything to do with raw materials and economies of scale. Probably the biggest difference in cost structure from GSMI is that Tanduay (and Emperador) require aromatics and barrel aging.

→ One thing to consider is that the San Miguel Corporation produces probably one of the largest volume of beverages in Southeast Asia. San Miguel beer is the primary beer brand in the Philippines and the most consumed alcoholic drink. What this means is that San Miguel beats all others when it comes to bulk purchasing. However, I think the added cost savings in terms of raw materials aren’t huge as really the only raw material that overlaps with Ginebra and San Miguel is glass for bottling via San Miguel Yamamura.

Distribution

Lackluster infrastructure and road systems, stemming from slow development and corruption, and being a multi-island country means its it’s much harder to ship.

The barriers to selling nationwide economically in the Philippines is enormous. Even early on, tapping into the wide SMC distributor network was incredibly valuable to getting Ginebra product to all corners of the country.

Read this from Ginebra’s 2000 annual report:

SMC controls a lot of the country’s infrastructure, especially in Luzon.

They operate several port terminals, inter island carrier fleets, hundreds of warehouse depots, and toll roads. All these allow for significant reach plus discounted transport cost.

For comparison, Tanduay has about 22 warehouses while LT Group, its parent, is really a banking and tobacco conglomerate. Emperador’s parent, Alliance Group, leaned more into casinos and hospitality. It’s really SMC that has overwhelming dominance in infrastructure.

SMC is also building the New Manila International Airport, MRT-7 railway which connects Quezon City to Bulacan, which could potentially allow for further connectivity.

….

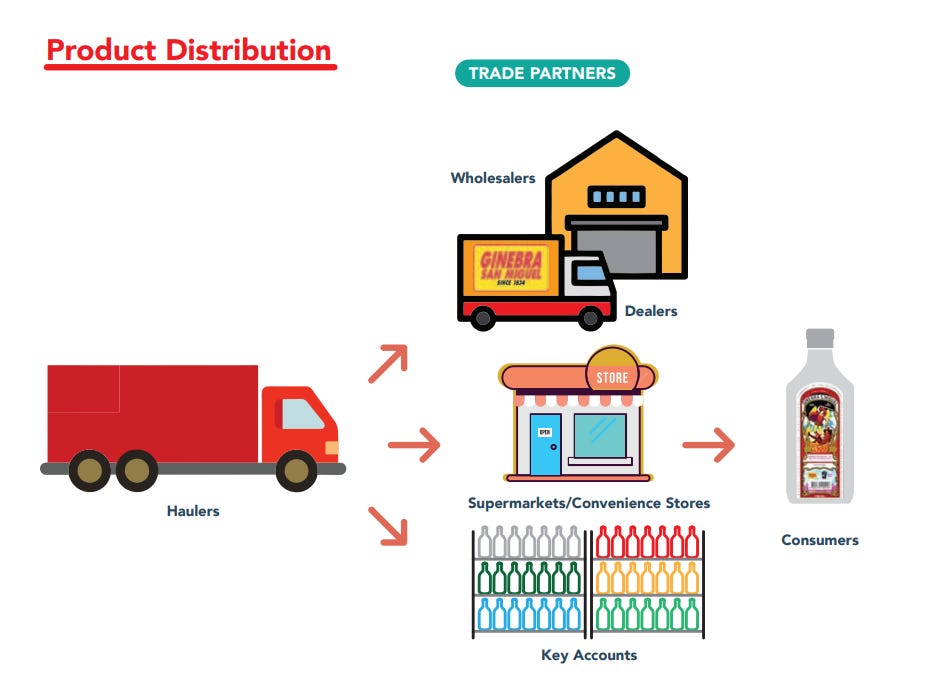

Once bottled, finished goods are sent to Ginebra’s 100 exclusive dealers via SMC’s network of truck fleet and warehouses that operate across the country. Each dealer is contracted to serve a specific region.

These dealers then sell to mostly to sari sari stores as well as wholesalers and large accounts such as Puregold, the Philippines largest supermarket.

Ginebra operates 17 sales offices which serve 158,000 accounts! One account for every 730 people.

What’s interesting is that having an extensive account network is very helpful in growing end-user accessibility. This is because many retailers buy from other retailers physically rather than having it delivered from wholesalers or distributors. One sari-sari store owner I found online said they sourced everything from the local market a few kilometers away. I found a similar situation on reddit where a store owner would buy from another nearby account and then resell, eventually finding the supplier of that seller and cutting out the middle-man. Either way, the way these products get around to the end drinker seldom involves formal contracts: further fragmenting the customer base and making sari-sari store reach more difficult.

(This might reverse if Purgold ends up consolidating the market. Puregold is often able to outprice a lot of mom & pop supermarkets and offer good membership discounts. I think as Puregold grows, slowly more and more sari-sari stores will buy directly from Puregold rather than their usual local markets. This will give more leverage to large bulk buyers like Puregold.)

…..

Ginebra sells to less than 12% of the country’s sari-sari stores. There is still room to expand to more routes and locations with minimal Ginebra presence. Within Luzon however, I think Ginebra is pretty saturated in terms of sales volumes. Visayas and Mindanao growth will mostly come from Vino Kulafu, though it’s going to be hard to beat Tanduay. I think instead, the growth runway opportunity comes from the following:

The B2Bar opportunity looks great if you’ve had the chance to visit the Philippines. Rapidly growing urbanization will promote a much larger commercialized night life. We are seeing low-mid-end karaoke rooms, clubs, and neighborhood bars pop up everywhere.

There is a ton of intra-migration towards Luzon as people seek white-collar jobs and opportunity. Many regions in Luzon outside of Manila are growing really really fast. The country overall has a fast growing population with a young median population compared to developed nations.

Greater disposable income across the board has led to a growing lower-middle and middle class. With higher wages, I think GSMI could price up continually. Now, there is a sweet spot, we might have people trading up to premium gins if this is the case but I think this is very unlikely.

With all these factors in mind, it is exceedingly clear that the main beneficiary of this will be GSM Blue. It is already the most used for cocktails and popular with the younger generation.

Nonetheless, the growth runway is not primarily in terms of sales volume but in pricing power, especially as the country is developing fast and incomes rise.

Marketing Strategies

Someone on VIC who wrote-up GSMI said this about their basketball team:

“GSMI owns Barangay Ginebra San Miguel, one of the leading professional basketball teams in the Philippines. Its costs are not separately disclosed. While this is not rare in emerging markets (e.g. Aefes in Turkey has a similar setup), it really is not good governance.”

I disagree with this for a couple reasons.

Firstly, having a basketball team in the Philippines is ENORMOUS for marketing. Basketball is the number 1 sport by a longshot.

Barangay Ginebra is probably the MOST popular team in the entire country. For a top PBA team to be owned by Ginebra is huge.

The San Miguel Beermen is the most successful with 30 titles to Barangay Ginebra’s 15 titles. Following is Magnolia Chicken Timplados with 14, all three indirectly owned by SMC. There are no other liquor companys with basketball teams. Tanduay used to have a team called Tanduay Rhum Masters but they disbanded twice after failing to secure any titles. Neither Emperador nor Tanduay currently have a team.

Even if Barangay Ginebra is probably operating at a loss, I think of it as an ongoing nationwide sponsorship campaign and incredibly valuable for mindshare.

Advertising is a big part of GSMI’s marketing strategy. While Emperador has long tried to position themselves as classy with actors in suits and ties, GSMI has truly leaned into appealing to the mass market, focusing on “masculinity” and casual as core themes. A big part of the brand is definitely this idea that Ginebra is a man’s drink, a rite of passage. Meanwhile GSM Blue’s marketing looks more modern and minimalist to appear to younger people and bars.

GSMI spends less than $30 million (P1.73 billion) a year on advertising and promotion, which translates to about P1.3/350ml bottle in marketing cost. For an ave. price of P70/bottle at 350ml , this gives a return on ad spend of over 54x!

Advertising and sponsorships isn’t a big requisite to grow long-term as the existing brand equity does 90% of the job. Still, it’s useful to see how Ginebra thinks of their position and how they reach their target audience.

Management

As noted by other investors, one of the major changes for GSMI over the past couple decades have been management and capital allocation. Let me explain:

Back then, the company was run by its long-time CEO Eduardo Cojuanco…

In 2010, GSMI took out P1.5 billion in long-term debt and increasing short-term debt by >30% from P3.8 to 5 billion, raising D/E from around 50% the previous year to almost 80%. Still, coverage was good, until Gran Matador was hit the following year, plunging GSMI into unprofitability exacerbated by the interest expense.

Now the short-term borrowing was drawn to add working capital to support growing volume. However, the long-term borrowing was drawn to “fund the permanent working capital requirements of the Parent Company.” This was bad because the parent company was effectively drawing its own debt from its subsidiary and it was at a high interest rate as well, (7.25-7.89%).

Back then, GSMI was also involved in a lot of different things. In 2007, they had expanded into Thailand which was never profitable. They also owned several non-liquor brands. In the 2000s, they were producing vinegar, condiments, sauces, and even jelly snacks. GSMI also acquired several brands from San Miguel Beverages as part of Cojuanco’s desire to consolidate more brands under GSMI. This included Magnolia fruit drinks, iced tea, San Miguel bottled water, and more.

So clearly GSMI had issues. With the decline of Gran Matador and subsequent profitability issues, change had to happen.

….

During the pandemic, Eduardo Cojuangco, then the longtime CEO, died, transferring the title directly under Ramon Ang. He is currently president and CEO of Ginebra. In 2024, he also became CEO and Chairman of both SMFB and SMC.

Ramon Ang was originally a car mechanic when he met Cojuanco, who became CEO of SMC after buying out a lot of the Zobel family’s stake in 1983. Now Cojuanco was known as a crony of the former president Ferdinand Marcos, famous for the martial law dictatorship.

Ang started in the cement sector of San Miguel, and later served as temporary president when Cojuangco had to flee the country alongside the Marcoses during the Edsa Revolution in the 80s. He eventually returned and tried and failed to run for president.

Later on, impressed by Ang’s management, Ang was elected vice-chairman in 1999 and Cojuangco eventually appointed him as President in 2002.

Under Ang and Cojuangco, San Miguel acquired companies with huge market share and diversified the firm into many areas, such as Southeast Asian alcohol and oil markets. This era saw San Miguel grow so much that it now accounts for around 6% of the Philippines’ total GDP!

Ramon Ang gradually assumed leadership and by 2012 had acquired majority of Cojuanco’s shares in SMC. By this time, Cojuanco was 77 and was welcomed the leadership change.

Left is Ramon Ang, Right Ed Cojuanco

Reading Cojuanco’s shareholder statements as long back as I could find, it seems Cojuanco was trying to build a bigger and bigger conglomerate which led to what I would describe a “mess”.

This involved numerous acquisitions, entry into different food and beverage industries, and adding new brands. Diversification appears to be one of Cojuanco’s goals, which led focus away from core brands under GSMI. GSMI had several random brands while SMC’s other subsidiary San Miguel Food and Beverage also had a mix of alcoholic and non-alcoholic brands, so the structure was messy.

My belief is that by 2012, Ang was really the one calling most of the shots and is thus the mastermind behind most of the GSMI reforms during the 2011 period of poor performance.

I think Ang’s direction for GSMI was really cutting out the fluff, streamlining the conglomerate, paying down debt, improving governance, and most importantly, focusing on Ginebra and Vino Kulafu.

Ang made several changes to the company that helped bring it out of unprofitability:

By 2013, they effectively ditched Gran Matador and redirected marketing effort and spend to Ginebra San Miguel and Vino Kulafu as well as expanding GSM Blue’s product line up.

Ginebra divested all non-liquor brands in 2015, making Ginebra a pure-play liquor company for the first time in many many years.

In 2017, COO Bernard Marquez was replaced by Emmanuel Macalalag (In 2024, Macalalag was promoted to COO of SMFB, with the GSMI COO position given to Cynthia Baroy, the previous CFO and who has been at Ginebra since 2006). Ramon Ang moved from Vice Chairman to President.

In 2017, SMC transferred its ownership stake in GSMI to San Miguel Food and Beverage, streamlining the group structure and aligning all food and beverage businesses under one integrated holding company.

In 2020, a dividend policy was released whereas before dividends would be upped and cut at management discretion if they needed cash. They also redeemed preferred shares.

They wrote off the loss making Thailand JV.

Capital allocation was redirected from business diversification to paying down debt, paying down all long-term borrowings in 2021. The next year, they placed over 20% of their cash balance into 7-year time deposits generating 6.9% in interest annually. While there are probably better ways to use the case, it sure beats letting it sit in the bank. The debt investment has since contributed to positive net interest income.

GSMI was brought out of unprofitability in 2016, thanks in part of consistently growing core brand sales amidst the same amount of operating costs.

Overall, Ramon Ang is no doubt an excellent operator. Like many Southeast Asian conglomerate founders, all his children hold high positions with SMC and SMFB. It’s a typical family-run business, though that in itself is not that big an issue. I think the concerns come down more to his net worth and age:

Ginebra San Miguel is 75.8% owned by San Miguel Food and Beverage, which is 88.8% owned by the San Miguel Corporation, which is 66.1% owned by Top Frontier Investment Holdings. Ramon Ang is the second-biggest shareholder of Top Frontier Investment Holdings, raising his stake from 26% to 35% in 2023. So Ramon Ang collectively owns 16% of Ginebra San Miguel, and he hasn’t sold any of it (side note: 52% of Top Frontier is still owned by the Zobels by the way, though Ang is the President and CEO).

This puts his GSMI stake at about $224 million USD. However, after selling his stake in Eagle Cement to SMC (which is clearly him using his own company to cash himself out bruh), he personally pocketed probably over a billion dollars. Bloomberg puts his net worth at $3.5 billion. I personally think it’s not that high because his Top Frontier is worth just $400 million dollars, even though their stake in SMC should be worth $1.8 billion. If you consider his Eagle Cement cash out and ownership in Top Frontier, his total net worth would be closer to $2-2.5 billion. Either way though, GSMI is a meaningful but not a high portion of Ramon Ang’s net worth. Moreover, the guy is 71, and I’m not sure if he has the drive a younger CEO would have.

I think he just needs to keep the flywheel running and not burden GSMI with parent company shenanigans, which to be fair he has done a good job since taking the helm. Though I believe Ginebra is a business good enough for an idiot to run.

….

Some Projections

I’m expecting around 5% annual growth in prices and volume growth. Eventually, I expect volume growth to be in the 2% range while price increases can continue to be about 5%. Remember, there hasn’t been a single year price increases have been below 7%. This should lead to after-tax earnings and free cash flow growth of 10% or more (could be lower with future growth capital projects).

With no multiple expansion and dividends reinvested, I’m estimating an annualized return of at least 15% which is already conservative compared to historical earnings growth. If P/E expands to 20x which I think it should, returns could be over 40%.

GSMI is simply an excellent business with long-term pricing power while trading at a steep discount to peers.

Thanks for reading!

If you would like to show your support, I would immensely appreciate it if you subscribed to Dunamis Investing. By subscribing, you can stay up-to-date on new write-ups, research, commentary, and portfolio changes.

Similiar valuation dynamics with RS in the US industrial space. Trad at reasonable multiples with steady earnings and solid divdend yield. These types of names get overlooked when everyones chasing growth, but thats where the opportunity is.